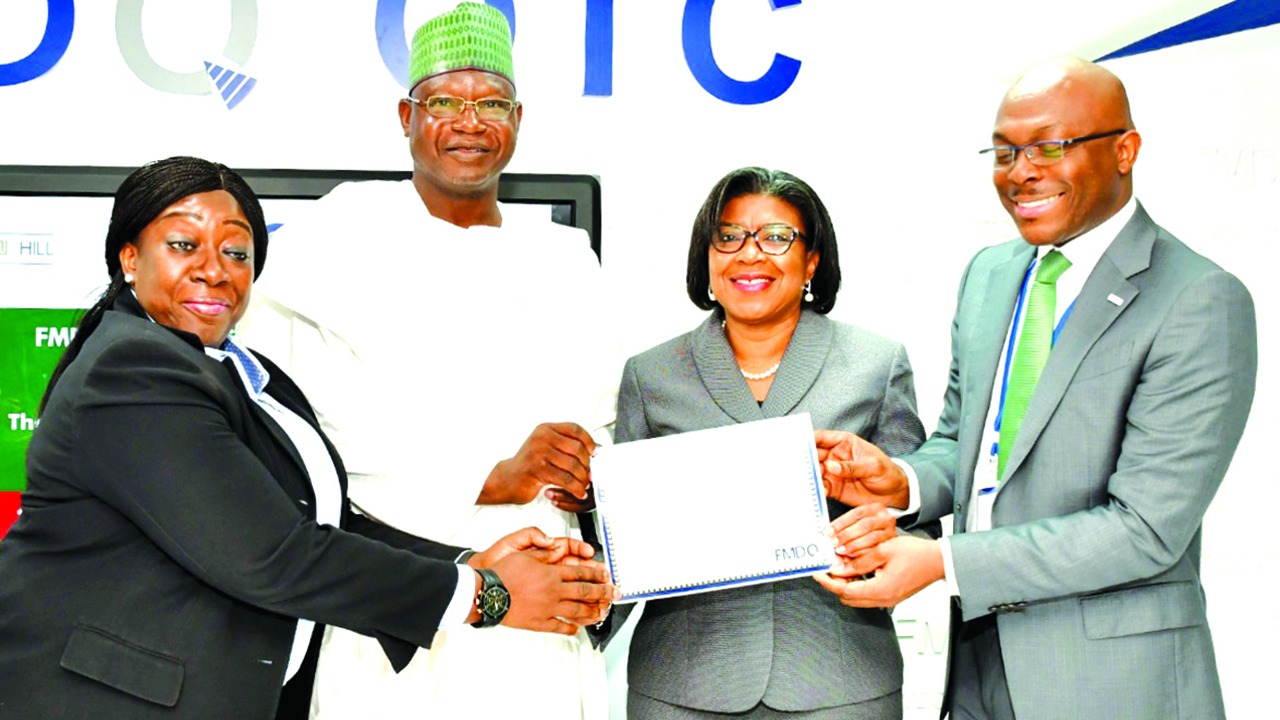

The Managing Director/CEO, FMDQ OTC Securities Exchange, Bola Onadele, while addressing financial market dealers at the pioneer listing of the bond in Lagos, on Friday, said the bond would accelerate the growth of DCM, and help address Nigeria’s infrastructure gap and environmental challenges in a sustainable manner.

He reiterated the OTC Exchange’s commitment to supporting initiatives of the Debt Management Office (DMO), towards the development of a highly liquid, deep and well-developed DCM in Nigeria.

He added that through consistent collaboration with its stakeholders, FMDQ would further deepen and position the Nigerian DCM for growth, in support of the realisation of a globally competitive and vibrant economy.

Also speaking at the occasion, the Director-General, DMO, Patience Oniha, explained that the issuance of the nation’s first sovereign green bond further demonstrates Nigeria’s commitment to the protection of the environment.

“ Nigeria endorsed the Paris Agreement on Climate Change on September 21, 2016, and undertook to achieving the Nationally Determined Contributions (NDCs), aimed at reducing carbon emissions by 20% unconditionally and 45%, with international support, by 2030. These projects require funding and the issuance of the green bond, the proceeds from which are dedicated to financing environmental projects, signals the Government’s commitment to funding the NDCs.

According to her, countries across the globe are resorting to mobilising funds from the DCM to finance environmentally friendly projects to support national development.

She added that DMO has taken a cue from other countries, by listing the first green bond in the Nigerian DCM.

“The Debt Management Office worked with the Federal Ministry of Environment and other stakeholders to develop guidelines and operational procedures for the green bond and the issuance of the debut green bond.

“The FGN has led this issuance, adhering to globally accepted standards and requirements, setting precedence for other categories of issuers such as sub-national governments and corporates to issue green bonds.

Further to the listing of this instrument, the DMO expects that trading will not only bring about climate change awareness but will also diversify the Nigerian capital markets and attract more investors.”

[ad unit=2]