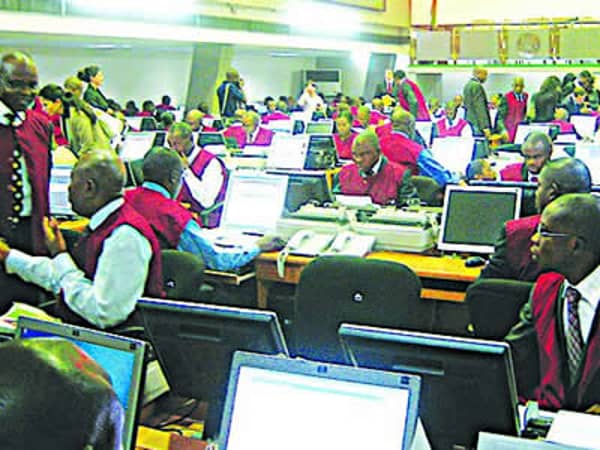

Despite the one-day holiday declared to commemorate Easter Monday Celebration, transactions in the shares of Diamond Bank Plc, Standard Alliance Insurance Plc and Transnational Corporation of Nigeria Plc, last week, boosted the volume of shares traded, as a turnover of 3.511 billion shares worth N25.196 billion was recorded in 26,836 deals by investors on the floor of the Exchange.

This volume of shares traded was, however, higher than a total of 2.632 billion units, valued at N36.583 billion, that changed hands in 21,393 deals.

Specifically, at the close of transactions last week, the financial services industry (measured by volume) led the activity chart with 3.000 billion shares valued at N18.262 billion traded in 16,356 deals; thus contributing 85.44per cent and 72.48 per cent to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with a turnover of 259.080 million shares worth N1.120 billion in 1,650 deals. The third place was occupied by the Consumer Goods Industry with 89.843 million shares worth N3.103 billion in 3,768 deals.

Trading in the top three equities namely- Diamond Bank Plc, Standard Alliance Insurance Plc and Transnational Corporation of Nigeria Plc (measured by volume) accounted for 1.773 billion shares worth N4.964 billion in 1,589 deals, contributing 50.49 per cent and 19.7 per cent to the total equity turnover volume and value respectively.

There was no bond traded this week. However, a total of 16,500 units of Bonds (Corporate bond 12,000 units and State bond 4,500 units) valued at N17.370 million were traded last week in six deals.

The NSE All-Share Index and Market Capitalization depreciated by 2.23per cent and 1.92per cent respectively to close on Friday at 34,930.02 and N11.903 trillion.

Similarly, all the Indices finished lower during the week with the exception of the NSE Consumer Goods and NSE Lotus II indices that chalked up by 1.04per cent and 0.34 per cent respectively. However, the NSE ASeM Index that closed flat.

25 equities appreciated in price during the week, lower than 72 equities of the preceding week. Fifty-three (53) equities depreciated in price, higher than six (6) equities of the preceding week, while one hundred and eighteen (118) equities remained unchanged, the same with the preceding week.

A total of 8,685,145,863 ordinary shares of 50k each at N5.80 per share were added to the outstanding shares of the Diamond Bank Plc on 9th of April 2015.

The shares arose from the rights issue, which was 100 per cent subscribed. The new total outstanding shares of the company now stood at 23,160,388,968 units.

The UBA Plc’s N45 billion (Series 1) seven years 16.45 per cent fixed rate subordinated unsecured notes due 2021 under a N345 billion medium term note programme was admitted to trade at the Exchange on 8th April, 2015.

The African Development Bank’s N12.95 billion 7-year 11.25 per cent fixed rate senior unsecured notes due 2021 under a N160 billion debt issuance programme was admitted to trade at the Exchange on 10th April, 2015.

Meanwhile, the Exchange announced that in furtherance to a directive of the Securities and Exchange Commission, the shares of Unity Bank Plc would be placed on full suspension from Monday, 13 April to Friday, 17 April 2015.

Consequently the qualification date (last trading day before the share reconstruction) is Friday 10 April 2015.