As part of the ‘Renewed Hope Agenda’ President Bola Tinubu’sadministration, the birth of the Consumer Credit Scheme /Corporation signals yet another landmark – a colour amber, in its key performance indicators.

To concretise the initiative, N100 billion has been earmarked for the take off of the first phase. According to available reports, the phase one of the scheme would kick off with the civil service. Thereafter, its cascading effect shall be felt by other segments of the Nigerian public.

Call the policy a novelty, and or even a lifeline of some sort, or worse still, stigmatise the amount as a drop in the ocean, you are not far from giving a veracious account of the development. Indeed, any ardent watcher cum analyst of the Nigerian socio-economic sphere can say that this is not only hilarious, it is also salutary to the extent that it may serve as an elixir that transmutes the debit economy to a credit one, going forward.

Contrariwise, and to the cynic critics of the Nigerian state, who are always quick at denigrating the present political leadership, this initiative portends nothing more than doing a mere public penance for the atonement of the multidimensional sins of this administration to vitiate the pangs of its harsh economic stance. Is this a jaundiced or an unbiased assessment of this policy initiative? Whichever way the pendulum may swing, does the preponderance of antagonism of the scheme outweigh its agonism? Will the response to this poser be adequate and sufficient enough to whimsically and perfunctorily fling the scheme with immense force as anti-development in the financial system?

Methinks that this developmental stride outweighs a mere actualisation of political slogan or a mere appeasement of the Bretton Woods or multilateral agencies that are often labelled as being surreptitiously moulding our present socio-economic reconfiguration. If anything, the bottom line is that it appears to be a right step in the right direction.

This becomes obvious given the fact that it may unlock credit opportunities and their potentials in the system, thereby alleviating some challenges attached to the perennial paucity of funds in the economy. Thus, this is incongruence with the editorial comment of the Vanguard of April 30, 2024: “The scheme will enable qualified Nigerians to have access to credit to enable them afford houses, cars, financing for their businesses and other socio-economic activities that make life more abundant as obtains in advanced societies. It will allow Nigerians to live a good life while repaying for their credits gradually over the years.”

Albeit, as gargantuan, robust and fatty as our economy appears to be, a N100 billion consumer credit scheme may be a mere pittance or better still, a drop in the Ocean for the elephantine financial landscape that the country parades. Viewed in this direction, can we interrogate further, this poser? Is the Federal Government’s financial commitment to the scheme a peanut? Your guess is as good as mine. Despite this, what is paramount is that the scheme will be successfully birthed in the Nigerian financial system.

Against the backdrop of this salubrious move, it has been proven in some contemporary nation states that the scheme is waxing strong despite the global economic difficulties. For instance, in contemporary South Africa, the TransUnion’s (NYSE:TRU) Q4 2023 reported that: “…the South African consumer credit landscape maintained its resilience during the last quarter of 2023 with a significant 11 per cent overall growth in originations – a measure of new accounts opened – across all products.”

This lends credence to the fact that consumer credit scheme plays crucial roles in the economic development of emerging economies. This is often attained by providing access to financial services for individuals who may not have access to traditional banking institutions. However, such scheme also comes with a unique set of challenges and prospects that need to be carefully considered in this discourse to ensure their effectiveness and sustainability.

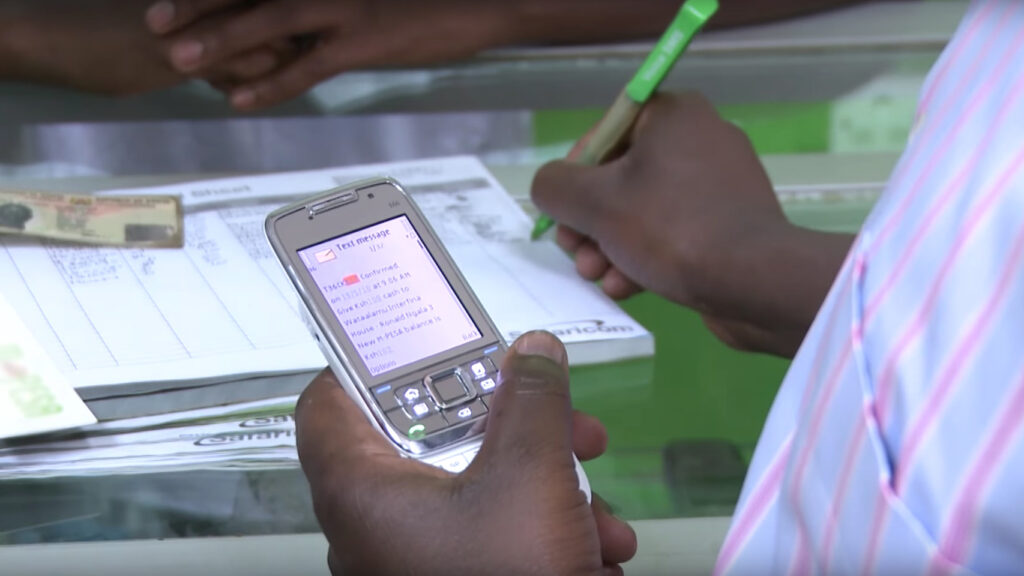

Given the above, one of the key challenges of a consumer credit scheme in an emerging economy like ours is the issue of financial inclusion. How far have we addressed this in Nigeria? Without mincing words, and but for the few noticeable hiccups, we are bound to be gleeful over the mirthful episodes that have characterized the payment system landscape within the last one decade or so. Put clearly, the Nigerian payment system has been rejuvenated and transformed to the extent that more people have been included in its ecosystem.

The results of the EFInA Access to Financial Services in Nigeria 2012 survey showed that “34.9 million adults representing 39.7 per cent of the adult population were financially excluded. Only 28.6 million adults were banked, representing 32.5 per cent of the adult population.”

Gratifyingly, and according to the World Bank, the financial inclusion rate has risen to about 64 per cent of the eligible populace in 2024. This signals that around 64 percent of the adult population in the country has access to financial services such as bank accounts, loans, investments, and digital payments. In the same vein, The Guardian of Wednesday May 8, 2024, presented an impressive growth trajectory in the values of electronic payments in Nigeria in the past eight years as “2016-N62trillion, 2017- N83trillion, 2018-N109trillion, 2019- N150trillion, 2020-N356trillion, 2021- N272trillion, 2022-N387trillion, and 2023- N600trillion.”

Despite this upbeat, there are still some challenges with infrastructure, making it excruciating for the average Nigerian to seamlessly cash in and out, via the electronic channels. For instance, power has remained elusive, while other supporting infrastructural facilities have been in comatose.

To be continued.

Dr. Adaramewa, a Lawyer and an ex-Banker wrote in from Lagos.