Rising from the just-concluded Summit for a New Global Financing Pact in France, World leaders have praised the African Development Bank (AfDB) for developing a practical roadmap for easing the debt burden for low-income countries and freeing up funds for climate needs.

The AfDB had designed a solution that would enable rich countries reallocate part of their Special Drawing Rights (SDR) to low-income countries through multilateral development banks. The technical solution preserves the asset reserve status of the SDRs and would unlock hundreds of billions for Africa.

The African Development Bank and the Inter-American Development Bank have been at the forefront of calls for the reallocation of the SDRs through multilateral development banks like themselves, to help rebuild livelihoods due to the impact of climate change and other global challenges.

Speaking at the pre-summit forum’s opening during the week, United Nations Secretary-General António Guterres noted that AfDB’s initiative of channelling SDRs to multilateral development banks, which would increase their impact five-fold, is a source of inspiration.

French President, Emmanuel Macron had convened the summit on New Global Financing Pact to find a roadmap for easing the debt burdens of low-income countries and freeing up more funds for climate financing. And delegates at the summit included several heads of state, heads of international financial institutions, including multilateral development banks, intergovernmental institutions, philanthropists, and global private sector business leaders.

Guterres said world leaders could implement a mechanism allowing SDRs to be issued automatically when a crisis occurs and distributed according to need. “They can put a price on carbon. They can end fossil fuel subsidies and reallocate this funding towards more sustainable and productive use,” he said.

Macron suggested four pillars that should underpin the new global financial pact, stressing that it must have the support of the people most affected by climate change.

The French President said: “First, no country should have to choose between fighting poverty and protecting the planet. Second, each country must follow its own path because there is no single model. Third, we need to take on a public funding shock. And fourth, we need more from the private sector to mobilise a lot of money.”

United States Treasury Secretary, Janet Yellen, underscored the importance of regional development banks in addressing development finance challenges and reducing vulnerabilities in developing countries.

“We are seeing important innovations begin to take shape across the African Development Bank, the Asian Development Bank, the Islamic Development Bank, and others,” Yellen said, calling for continued partnership between the World Bank and regional development banks.

Yellen called for reforms at the World Bank. “We must continue to pursue ambition on reforms at the World Bank,” she said. “The World Bank should develop a framework on principle concessional resources so that financing to address global challenges is deployed to where it has the highest impact,” she emphasized. She also recommended to “offer borrowers the option to add climate resilient debt clauses to their loan agreements so they have a greater buffer if climate related events strike.”

World Bank President, Ajay Banga, who assumed office earlier this month, acknowledged the crucial role of regional development banks and pledged a closer partnership with the African Development Bank.

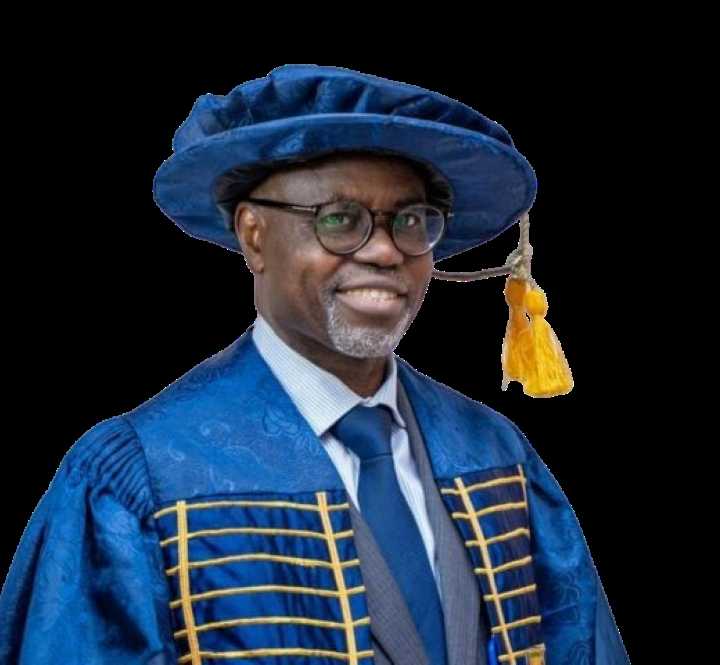

Banga said: “My first visit as a nominee was to Côte d’Ivoire to meet with the AfDB President, Akinwumi Adesina. So, I think in many ways we have to work in partnership.”

Speaking during a panel discussion, titled, “Debt and SDR-channeling: where do we stand and how to go further?,” Adesina said multilateral development banks could leverage an allocation of $200 billion, as an example, and turn that amount into a trillion dollars.

“The MDBs are leveraging machines,” Adesina said. He added: “They can leverage the SDRs by three to four times. So that leverage is very important to have.”

With 21 African countries in or at high risk of debt distress, Adesina noted that the G-20 Common Framework for Debt Treatment was vital. He said there was no time to waste. “So, we do have to make it work faster, work at scale … very, very important,” he stressed.

During the panel discussion, the IMF Managing Director Kristalina Georgieva, announced that the Fund had reached its target of making $100 billion in special drawing rights available for vulnerable countries.

President Mohamed Bazoum of Niger—one of the African countries that have been hard hit by crises, including drought and flooding—called for the Paris meeting to be more than just another meeting.

“This meeting must make it possible to build an ingenious toolbox in which funding will have to be better shared,” Bazoum said, adding: “It must include the monetisation of carbon quotas and special drawing rights.”

Bazoum said he expects the new pact to make concrete and operational the aid promised by the Paris Agreement ($100 billion per year) and the commitments by countries signatory to the Glasgow Climate Pact to revise and strengthen their 2030 targets to bring them in line with the temperature target of the Paris Agreement. He said: “There is a short-term emergency in the global emergency. So, we need to increase the financing capacity of the multilateral development banks. We have only one planet, and we are at a historic turning point.”

Prime Minister Mia Mottley of Barbados—who, ahead of COP27 in 2022, announced the Bridgetown Initiative, a political agenda for the reform of the global financial architecture and development finance in the context of three intersecting global crises of debt, climate, and inflation—called for a total transformation of the world of financing.

Motley said: “Today, we are in Paris with hope. We are asking for a total transformation of our institutions, not a simple reform. What’s more, we mustn’t let companies or philanthropists do what they want but what the world needs. If we don’t invest on a large scale today, we won’t achieve the goal of saving the planet. Everyone has to share the burden.”

During a presidential dialogue on accelerating investment in green infrastructure in Africa, several other world leaders, investors, and heads of intergovernmental institutions commended the creation of the Alliance for Green Infrastructure in Africa (AGIA) by the African Development Bank, Africa50 and the African Union Commission. Many expressed the commitment to join the $10-billion initiative, which is working with African countries and the private sector to speedily develop green and climate-resilient projects at scale.

Philanthropist Mark Gallogly, co-founder of the Three Cairns Group, announced a $5-million grant for AGIA. Philippe Valahu, CEO of the UK’s Private Infrastructure Development Group, Emmanuel Moulin, director-general at the French Treasury, Sidi Tah, head of the Arab Bank for Economic Development in Africa, and Serge Ekue, president of the West African Development Bank, said they will join the Alliance.

In remarks during the presidential dialogue, Kenyan President, William Ruto expressed Africa’s commitment to working together with industrialised nations to find practical solutions to develop faster and greener.

Ruto stressed: “We want to be at the table where we are all looking for solutions. That is why we are in this conference. We have not come here to complain to anybody. We’ve come here because we want to look for a solution. We want to come up with a win-win.”

Along with the seven other heads of state who attended the event, Ruto expressed his full support for AGIA and the African Development Bank’s initiatives to fast-track Africa’s development.