• Capital expenditure bears brunt of IGR deficit

• Expert seeks curb in corruption, political interference on tax

• Wants high net worth individuals captured in tax net

Lagos State’s Internally Generated Revenue (IGR) for 2021 might have suffered a N180 billion shortfall at the end of the year.

The full figure has not been officially released, either by National Bureau of Statistics (NBS) or the state government. However, if available statistics for quarter one cum half year and comments by Commissioner for Finance, Dr Rabiu Olowo, are anything to go by, then the state had an average N15 billion monthly deficit in 2021.

In the approved 2021 budget, the state had projected generation of at least N60 billion monthly to finance the budget signed into law by Governor Babajide Sanwo-Olu. The state government, however, did not meet the target, as it could only generate an average of N45 billion monthly.

Commissioner for Budget and Economic Planning, Mr. Sam Egube, while providing breakdown of the 2021 budget, after it was approved, disclosed that the state targeted N723.8 billion IGR to finance the budget. This implied that the state should generate, on average, N60 billion monthly, if it must meet the yearlong target.

But the quarter one and half year statistics by NBS revealed that the state generated N127 billion and N267.23 billion in quarter one and half year respectively in 2021. Also, a breakdown of NBS statistics revealed that the state generated N44.5 billion monthly. If the state had met its monthly IGR target, at the end of quarter one, it should have generated N180 billion as IGR, as against N127 billion. Also, at the middle of the year, it should have generated N360 billion as IGR, as against N267 billion.

Speaking, last month, at the 149th Joint Tax Board (JTB) meeting in Lagos, Olowo said: “I am pleased to let you know that Lagos State has grown its IGR from N600 monthly in 1999 to over N45 billion monthly as of today.”

If the N45 billion monthly IGR figure is multiplied by 12 months, the state generated N540 billion in 2021, as against the N723.8 billion it projected. This implies that the target was not met by about N183 billion.

Similarly, looking into the state’s spending in the last two years, capital expenditure might have borne the brunt of the shortfall in IGR.

In 2019, the state projected N479.6 billion as capital expenditure but ended up spending N241 billion, which was just a little bit above 50 per cent of the expected capital expenditure. On the other hand, while the state was expected to spend N393.8 billion on recurrent expenditure, it ended up spending N555.6 billion. In 2020, the state allocated N508.9 billion for capital expenditure but ended up spending N304.9 billion. And while it planned to spend N411.6 billion on recurrent expenditure, it eventually spent N386.5 billion.

A tax consultant, Prof. Godwin Oyedokun, noted that budget and expected revenue are based on assumptions, which may be achieved or not. He said this explains why there are supplementary budgets sometimes. He noted that if the economy does not follow lines of assumptions, the target might not be met.

He said a budget might be based on assumption of collecting tax from 20 people. If one or two people are not available to pay, however, the expected revenue will not be achieved.

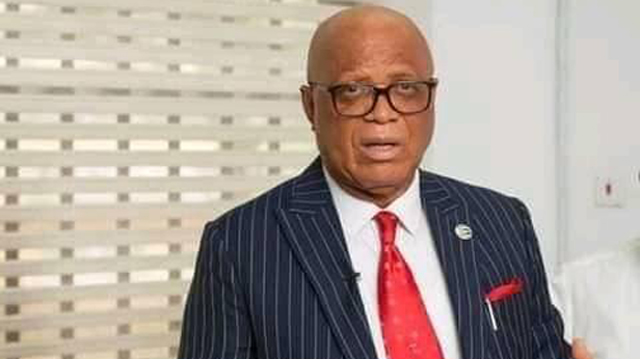

Chief Executive Officer, Dignity Finance & Investment Limited and former Director General, Abuja Chamber of Commerce and Industry (ACCI), Dr. Chijioke Ekechukwu, noted that Lagos State is adjudged as having the largest IGR in Nigeria. But not meeting the target of N60 billion monthly in 2021 might mean the target was overambitious or there were collectibles outside the tax net of the Inland Revenue Service (IRS).

He said: “The state has to be more efficient in identifying high net worth individuals, who don’t have offices or known businesses, by tracking their funds through banks and fintech transactions. The state can introduce sin taxes that target alcoholic beverages, cigarettes among others.”

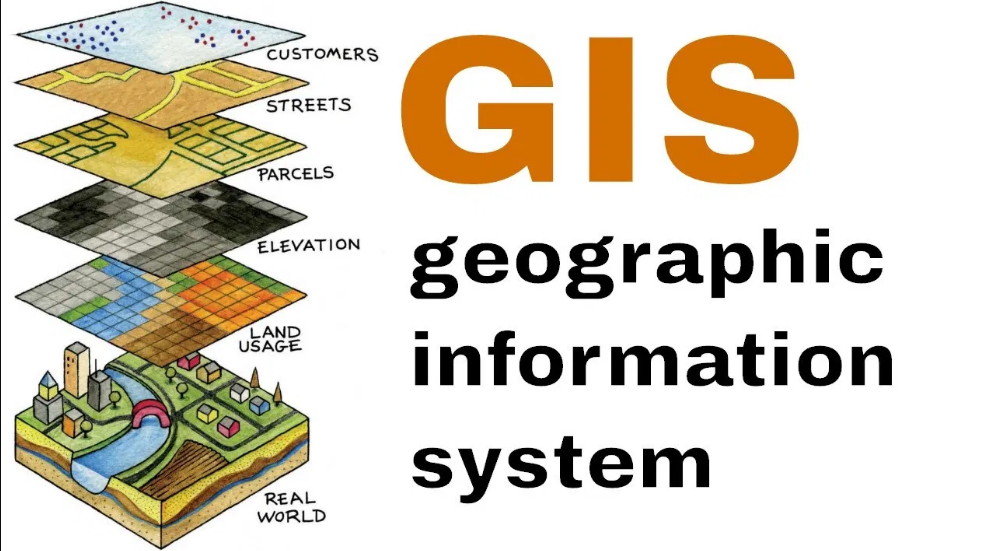

He noted that improved deployment of information technology would enhance collections. “The state also needs to fight corrupt practices in this space by curbing diversion of collected funds and eliminating compromises,” he said.

Partner, Fiscal Policy and Africa Tax Leader, PwC, Mr. Taiwo Oyedele, noted that the revenue performance of Lagos is commendable, given that the state managed to increase its IGR in 2021, compared to previous years.

He, however, said there are significant revenue gaps in key areas, especially taxation of high net worth individuals, direct assessments, informal sector, digital economy, stamp duties, and Land Use Charge.

“I believe the state can easily achieve a monthly IGR of over N60 billion with the right strategy to capture tax evaders and expand the tax net using data for tax intelligence.”

He added: “To achieve the target, Lagos State would need to cut off political interference in tax administration including the use of various agents for tax audits. The Lagos State Internal Revenue Service needs to be empowered, funded and resourced to a world- class level for better effectiveness.”

For economist and lecturer at Covenant University, Ota, Ogun State, Dr. Sunday Adediran, Lagos State government should urgently block IGR loopholes and develop border town roads to encourage more investment from states like Ogun and Republic of Benin. It should also leverage on modern technology.