• Urge FG to bring down cost of governance

• Levy contradicts international trade agreements, obligations

Industry stakeholders have expressed deep concern over the recent introduction of the Expatriate Employment Levy (EEL) by the federal government, saying the country may be perceived as hostile.

This perception, the Lagos Chamber of Commerce and Industry (LCCI) said, is harmful to the country’s drive for foreign direct investments (FDIs) inflows. Similarly, the Manufacturers Association of Nigeria (MAN), also expressed concern over the levy, saying it is potentially an albatross to the realisation of the President’s private sector-led economy aspirations and would certainly ruin the trust and confidence he is striving hard to build among domestic and foreign private investors.

According to the government, the policy aims to address wage gaps between expatriates and the Nigerian Labor force while encouraging skills transfer and the employment of qualified Nigerians in foreign-owned companies.

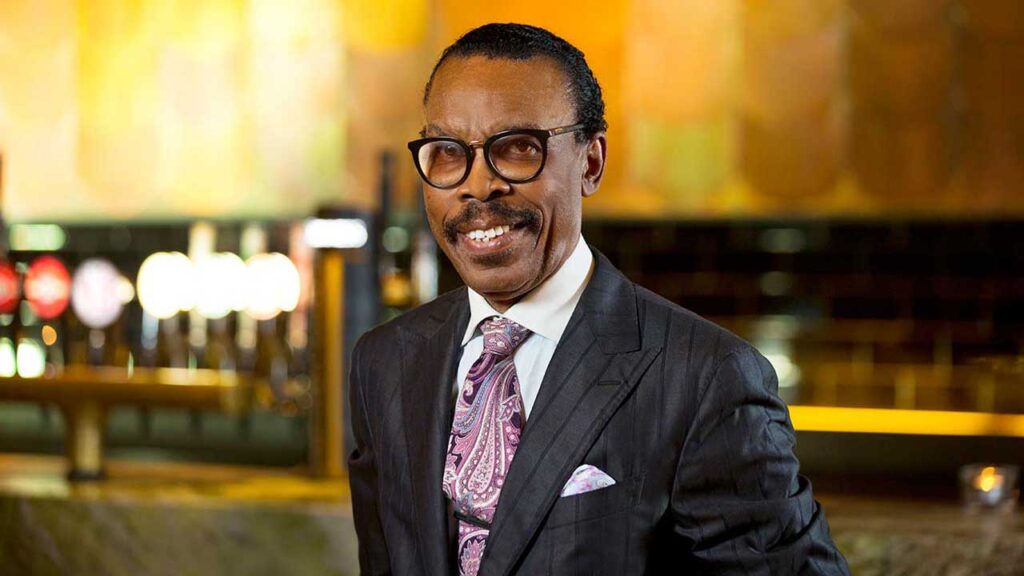

Speaking with The Guardian, the Director-General of the LCCI, Dr Chinyere Almona, said there is an urgent need for a balanced approach to expatriate employment and its potential impact on FDI inflows.

On his part, MAN’s Director-General, Segun Ajayi-Kadir, said the levy will simply deter foreign direct investments, disincentivize domestic investors who have partnership with foreign investors and undermine knowledge transfers critical for Nigeria’s economic growth.

The manufacturing sector, he said, is already beset with multidimensional challenges. Last year, 335 manufacturing companies became very distressed and 767 shut down completely.

“The capacity utilisation in the sector has declined to 56 per cent; interest rate is effectively above 30 per cent; FX to import raw materials and production machine inventory of unsold finished products has increased to N350 billion and the real growth has dropped to 2.4 per cent. Expatriates in Nigeria currently pay over $2000 for the Combined Expatriate Residence Permit and Alien Card (CERPAC). The sector cannot afford another disincentive to increased investment and portfolio expansion,” he said.

According to the Nigerian Bureau of Statistics (NBS), Nigerian nationals constitute just 59 per cent of total jobs in Nigeria, with their wages accounting for less than 45 per cent of total wages, while the average basic salary of expatriates stands at over 45 per cent above the basic salary.

Almona said that while they support government policies that enhance the profile of the business environment, generate more revenue for the government and create more opportunities for local employment, there is also the strong possibility that the business environment might be perceived as unfriendly to foreigners. She went on to add that now more than ever, the country needs a conducive business environment to attract the right kinds of investment into the country.

“Capital importation into Nigeria in the fourth quarter of 2023 stood at US$1.088 billion out of which only 16.90 per cent (US$184 million) came in as FDI. We call on the government to consider exempting sectors that require unique skill sets for projects carried out in the country, especially in construction, and other sectors where we have a critical shortage of supply of goods to meet rising demand. In sectors where the country cannot boost the supply of critical products like food, cement, drugs, and other agricultural inputs, we urge the government to charge concessionary or exempt the manufacturers in these fields to encourage investors to come in and boost the supply of such scarce products.

Almona went on to add that the imposition of the levy means expatriates will now be subjected to two administrative procedures to procure, CERPAC and the EEL.

“From experience, having two procedures will mean more human interfaces, more bureaucracy and more application costs. We recommend that the government continues to work with the already established and functional CERPAC, with the provision for yearly or regular reviews in rates according to internationally accepted rates. This way, we present our economy as open for business,” she said.

Expressing fears that the new policy may cause unintended consequences that may trigger the relocation of foreign companies to neighbouring countries that present a more conducive and less expensive environment for business, she said it will likely spark retaliatory actions taken by other countries by imposing levies on foreigners and particularly targeting Nigerian workers. This, she said, will in turn affect diaspora remittances from Nigerian workers resident in other countries.

“We expected that issues like a levy on foreign workers with tax implications would have been brought before the Presidential Committee on Fiscal Policy and Tax Reforms for input that aligns with their mandate of improving the business environment. There is also a need to align the provisions of this levy with existing frameworks like the Nigerian Content Development and Monitoring Board (NCDMB), existing incentives granted to pharmaceutical companies by the National Agency for Food and Drug Administration (NAFDAC) and the Nigerian Civil Aviation Authority (NCAA).

“Maintaining expatriates in Nigeria is expensive and our members only bring in expatriates for very critical roles that require highly technical skills that are not readily available locally. It is out of necessity that our members bring in expatriates and any imposition that makes this provision expensive will discourage and even jeopardise projects requiring such expatriates,” she said.

Ajayi-Kadir said MAN is concerned that the EEL contradicts international trade agreements and obligations. “For instance, Nigeria is a signatory to the African Continental Free Trade Area (AfCFTA) agreement. One of AfCFTA’s pillars is the free movement of skilled labour across the continent, which is complemented by non-discriminatory measures against fellow Africans.

Quite importantly, this could trigger retaliatory measures against Nigerians working across Africa and other nations of the world; frustrate regional integration efforts and portray Nigeria as a spoiler.

The policy will surely undermine the administration’s determination to position Nigeria as an attractive global investment destination and may engender a cold welcome in the President’s future foreign investment promotions endeavours, as well as undermine our efforts at becoming a hub for shared services center and business process outsourcing,” he said.

MAN said the punitive levy is already being perceived as punishment imposed on investors for daring to invest in Nigeria and indigenous companies for employing needed foreign nationals. “This will deter multinational companies from either investing in Nigeria or setting up regional headquarters in the country. Also, the levy will make Nigeria a more expensive location for global expertise that international companies require for their operations. Overall, we risk slowing down knowledge and skills transfer to Nigerians and undermining a key avenue for the country to move up the technology ladder.”

He also expressed worry that the levy could have far-reaching implications for the economy and potentially exert pressure on the Naira. This levy, if not reversed, he said, may expose the Federal Government to a plethora of lawsuits that will distract the government from the task of salvaging the current dire situation of the economy.

“We already have laws promulgated to achieve the exact purpose for which the EEL was introduced, including the Local Content Act which guarantees the jobs of Nigerians and the Immigration Act which prescribes the primacy of consideration for Nigerians and imposes appropriate quotas in the engagement of expatriates. Therefore, the EEL would amount to a duplication and a burdensome addition.”

Also expressing concern, the Nigeria Employers’ Consultative Association (NECA), said that the levy could undermine ongoing fiscal reforms.

In an open letter directed to the Minister of Interior, Olubunmi Tunji-Ojo, the body said expatriates living and working in Nigeria are already burdened with a slew of escalating levies; ranging from $1,000 to $2,000 for CERPAC processing, in addition to administration fees of between $50 to $200.

They added that the policy will negate the efforts made at attracting FDI, starve businesses that need expertise and weaken fiscal reforms. NECA also highlighted that now that the country is witnessing a significant departure of companies, exacerbating the already critical issue of rampant unemployment, the government has been consistently introducing policies on an almost weekly basis. These policies, according to the body, carry the potential for adverse effects on the economy, thereby worsening the nation’s economic challenges.

Almona argued that other economies, such as the United Kingdom and the United States, collect charges on expatriates in the form of visa fees at the point of processing entrance for foreign workers coming into their countries.

“Countries like Singapore and Malaysia charge a foreign worker levy with several exemptions according to industries, duration, skills and so on. There is a need for this policy to be reconsidered in terms of the proposed rate, implementation timeline and possible combination with the CERPAC permit,” she said.

She acknowledged the government’s efforts to boost local employment and skills development but said a careful balance must be struck so that the levy does not become an inhibition to attracting and retaining foreign investments crucial for economic growth.

In related development, the LCCI DG also urged the Federal government to urgently trim the cost of governance, describing it as burdensome and unsustainable. She said this is particularly necessary at this point when the government is asking Nigerians to make sacrifices. It is vital, she said, to make deliberate efforts to reduce the cost of governance and ensure a more efficient, agile, and technology-driven public service.

She however added that the overall effectiveness of this effort would depend on the strength of the government’s will to carry out this exercise as announced.

Applauding the decision by the government to implement the report on the Rationalisation and Restructuring of Federal Government Parastatals, Commissions and Agencies as commendable, she said it is better late than never as Nigerians have been clamouring for a reduction in the cost of governance in the face of worsening economic conditions.

The head of the committee then, Stephen Oronsaye, said if the committee’s recommendations were implemented, the Government would save over N862 billion between 2012 and 2015. That figure has likely tripled almost a decade later.

She added that beyond the initial excitement and applause, there is a need to see a clear action plan for the implementation model that avoids an over-bloated structure, which worsens bureaucracy and reduces the chance of service inefficiency due to loss of expertise.