• Net domestic credit down by seven per cent

• Fresh investments, jobs in tailspin as banks dominate investment market

• Private sector operators shunning fresh credits, banker claims

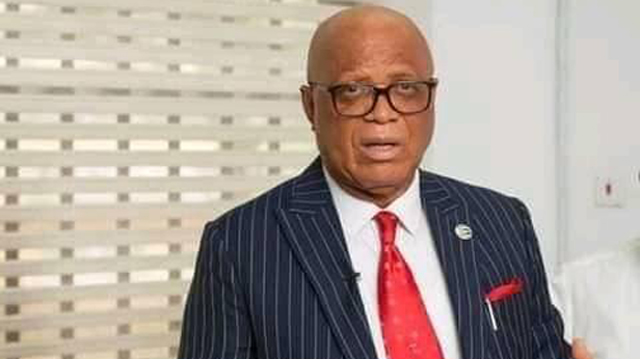

• Owoh: Economy on ‘siddon look’ mode

Less than three months into bank recapitalisation, the extensive fund-raising programmes may be shocking the economy as credit to the private sector continues to go south in the last few months, market data have revealed.

Data obtained from the Central Bank of Nigeria (CBN) showed that lending to the private sector has contracted by as much as N3.56 trillion in nominal terms within three months leading to the end of April, In the same period, the net domestic credit balances caved in by as much as N7.1 trillion.

Whereas the growth is not expected to follow a linear progression, the sharp fall in private sector credit growth is not a usual pattern – at least the trend has not been witnessed in recent years. On the aggregate, credit to the private sector has seen a modest 16.6 per cent year-on-year growth, expanding from N62.5 trillion to N72.9 trillion.

But the spike witnessed in the first two months of the year has cooled off with March alone seeing a 12 per cent contraction. It was the first time in recent years the data would witness such an abrupt reversal, suggesting a possibility of a breakdown in the uptrend seen in over a decade.

Nigeria has experienced massive growth in nominal private credit in recent years. Last year, the figure limped by 50 per cent, from N41.5 trillion to N62.5 trillion, though the real growth would be negative considering that naira lost over 50 per cent of its value to the dollar in the year.

Not even the ultra-high interest rate has halted the growth. For instance, from May 2022 when the current interest rate hike campaign started till last February, private sector credit rallied from N38.46 trillion to N80.86 trillion. The 110 per cent growth demonstrated the resilience of both the banking sector and the economy.

The trend in the last decade also reflected the post-low interest rate regime. From December 2013 to the end of last year, the private sector credit grew by almost four-fold, jumping from N16.2 trillion to N62.5 trillion. Yearly change, including during COVID-19, has maintained a consistent positive progression in the intervening years.

But this year could be an exception as banks switch attention to addressing their capital shortfall, experts have suggested, even as there are fears that the recapitalisation programme could potentially trigger a crowding-out effect on private sector investment.

During Prof. Charles Soludo’s banking consolidation, the economy saw a certain level of volatility in credit expansion. But overall, private sector credit grew by 32 per cent – from N1.39 trillion in July 2004 when the programme started to N1.84 trillion at its closure.

Sadly, the current programme is implemented alongside a contractionary monetary policy regime that has seen commercial interest rates climbing to 35 per cent. Hence, the current credit crunch could be caused by low credit demand and not supply shock.

Interestingly, the evolving shock may not stop at the doorsteps of the private sector operators. Total credit to the public sector also was 41 per cent shaved off its all-time high of N33.93 trillion in two months, dropping to N19.98 trillion at the end of April, implying that the public sector operators are not receiving fresh credits as fast as they are repaying what they owe their creditors.

Lending to the public sector grew by a staggering 88 per cent from May 2022 when the interest rate was first raised after years of hold to last February. But with the creditors either holding back lending or the debtors considering the cost of funds unaffordable, the growth may have hit the roof in the year.

Overall, the net domestic credit crawled back by N7.1 trillion from a January high of N100 trillion to N92.9 trillion in April. A consistent fall could pull the figure to last year’s average monthly balance, which was N78.5 trillion. A bank source told The Guardian at the weekend that the challenge is a combination of the two factors – demand and supply shock.

“Many borrowers cannot afford the going interest rate. There is high uncertainty, so many people are not sure they are not shooting themselves by taking fresh loans. Some banks, too, do not seem to have enough liquidity to seal new transactions,” a senior banker explained.

Another insider source told The Guardian yesterday that many of the banks have re-priced risky lending, thus excluding many “traditional customers” from the baskets. It was learnt that some debtors are being compelled to liquidate facilities ahead of maturity as they cannot afford the new interest rates.

If credit supply is triggered by the ongoing recapitalisation, the economy could be in for a long shock. First, the recapilisation will not end until March 2026, meaning the economy would need to ensure an extended funding drought – this and next year.

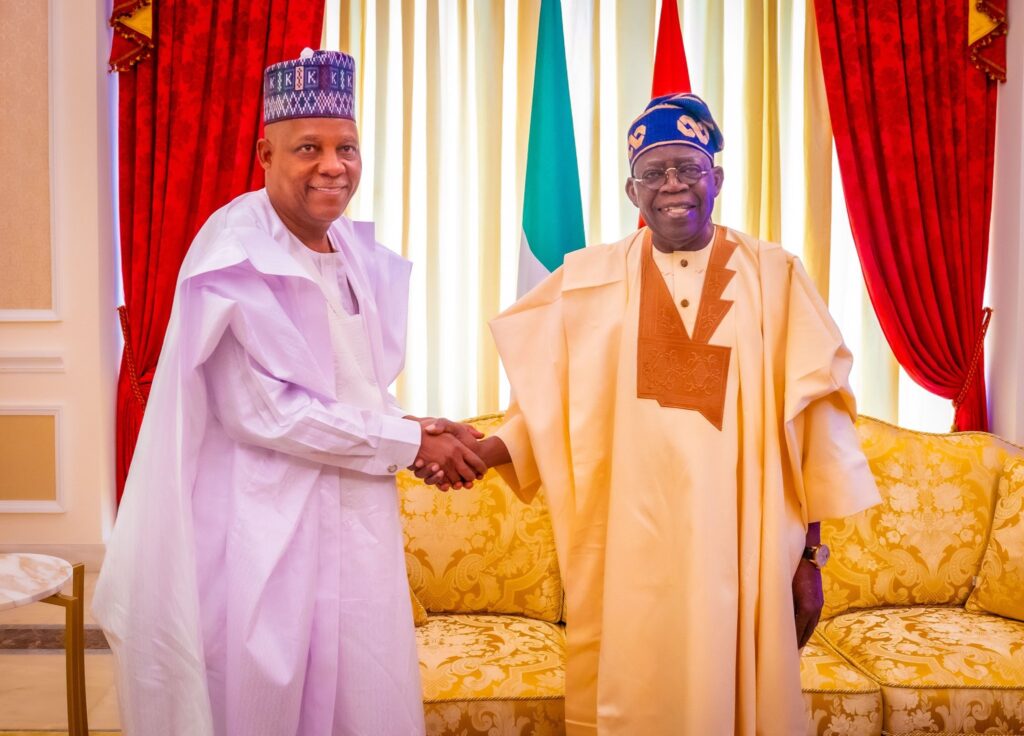

With a potential credit crunch, the ambitious recapitalisation could hurt other sectors in two ways. Plus, the limited credit advancement, domestic and external investments, as observed by Godwin Owoh, a professor of applied economics, will flow to banks through rights issues and public offers (POs), which have commenced in earnest.

Most of the banks have rolled up their sleeves in search of external funding to increase their capital in line with the new regulatory threshold. Access Holding Plc, the parent company of Access Bank, for instance, is raising a staggering $1.5 billion through a blend of equity and debt issuance while Zenith Bank Plc has opted for share capital to double its share capital.

FBN Holdings Plc has laid out a plan to raise N300 billion from the market just as other tier-one banks have equally unveiled ambitious fund-raising programmes that experts said could potentially kill the fund-raising dreams of non-financial institutions in the next two years.

Tier-one banks and other struggling financial institutions, which sources said are gripped by the fear of being cannibalised, are waiting for crumbs from the big players while they are also dropping their prospectuses for fund-raising purposes. Last week, for instance, Fidelity Bank Plc signed an agreement to raise about N127.1 billion from a public offer and rights issue.

Whereas a former member of the Monetary Policy Committee (MPC) and professor of economics at the University of Ibadan, Adeola Adenikinju, noted that the credit squeeze could be triggered by a potpourri of factors, he said capitalisation would not “necessarily slow down credit as the CBN guidelines excluded shareholders’ funds in the calculation of the new capitalisation”.

“I think it is a combination of all the factors you listed above. The lending rate has gone up significantly and the demand for credit has probably slowed down. It is more attractive to more risky projects that could afford the high lending rates. In addition, the business environment is very difficult for businesses. Hence, they may be wary of demanding new credit.

“On the supply side, the relaxation of the lending to deposit ratio by the CBN may make banks favour fixed-income assets with good yields relative to high-risk credit given the macroeconomic environment,” the economist noted.

Indeed, yields on government security have been uptick year-to-date with 10-year bonds rising from 14.4 per cent in January to their current 19.5 per cent. Banks may have been moving the debt instruments rather than funding the risky private sector, especially with little allowance for upward interest review for risky asset pricing.

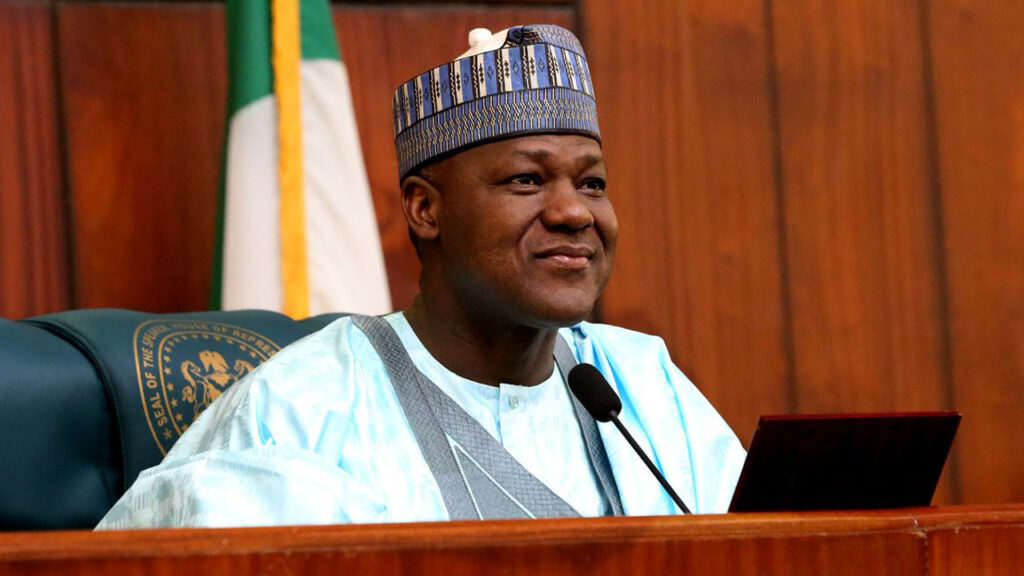

Owoh described the slow lending rate as “economic fruits (which) reflect seeds” sowed in the form of poorly formulated policies and the chaotic implementation process.

“Consequently, the credit crunch is a realistic outcome ex-post. It shows that considerable decision panic and uncertainty pervades the major segments of the economic environment. Economic agents can no longer make medium to longer-term decisions with comfort due to high voltage volatility. Hence, credit trajectory slopes fast south…

“Households, firms, and indeed the big independent private business concerns in Nigeria cannot compete for credit with the government sector. Justifiably, genuine borrowers and lenders are at optimum at the current level of ‘siddon look’, Owoh explained.

Also speaking, an associate professor of economics at the University of Lagos, Joseph Ayoola Omojolaibi, linked the challenge to “low availability of funds in banks”, which is, in turn, caused by low savings and credit tightening.

The Director-General of the Centre for the Promotion of Private Enterprise (CPPE), Dr Muda Yusuf, observed that the monetary tightening may have started yielding the desired result, from a monetary policy intervention perspective.

“Interest rate is currently around 30 per cent. It is difficult to imagine any business anybody can do that will give a return of 30 per cent. That, of course, is a disincentive for borrowing. Another reason could be as a result of the increase of the cash reserve ratio (CRR) to 45 per cent. If your CRR is 45 per cent and you need to keep another 30 per cent in the liquidity ratio (LR), it means you are left with 25 per cent to play with, which has constrained the capacity to lend,” Yusuf noted.

Yusuf also argued that default has risen dramatically leading to stiffer conditions, he added that the remnant of credits on banks’ books exists, which the borrowers do not have a choice but to continue to service at a cut-throat cost.