Stakeholders in the private sector have urged Nigerians, especially, business owners to subscribe to Takaful insurance products hedge against uncertainties and risks in business operations.

The stakeholders, who spoke in an event themed: “Takaful: The Next Frontier For Insurance,” organised by Noor Takaful Insurance Limited, in Ibadan, Oyo State said Takaful insurance is the financial model that remains an alternative and complementary system of financial intermediation for the benefit of Nigerians.

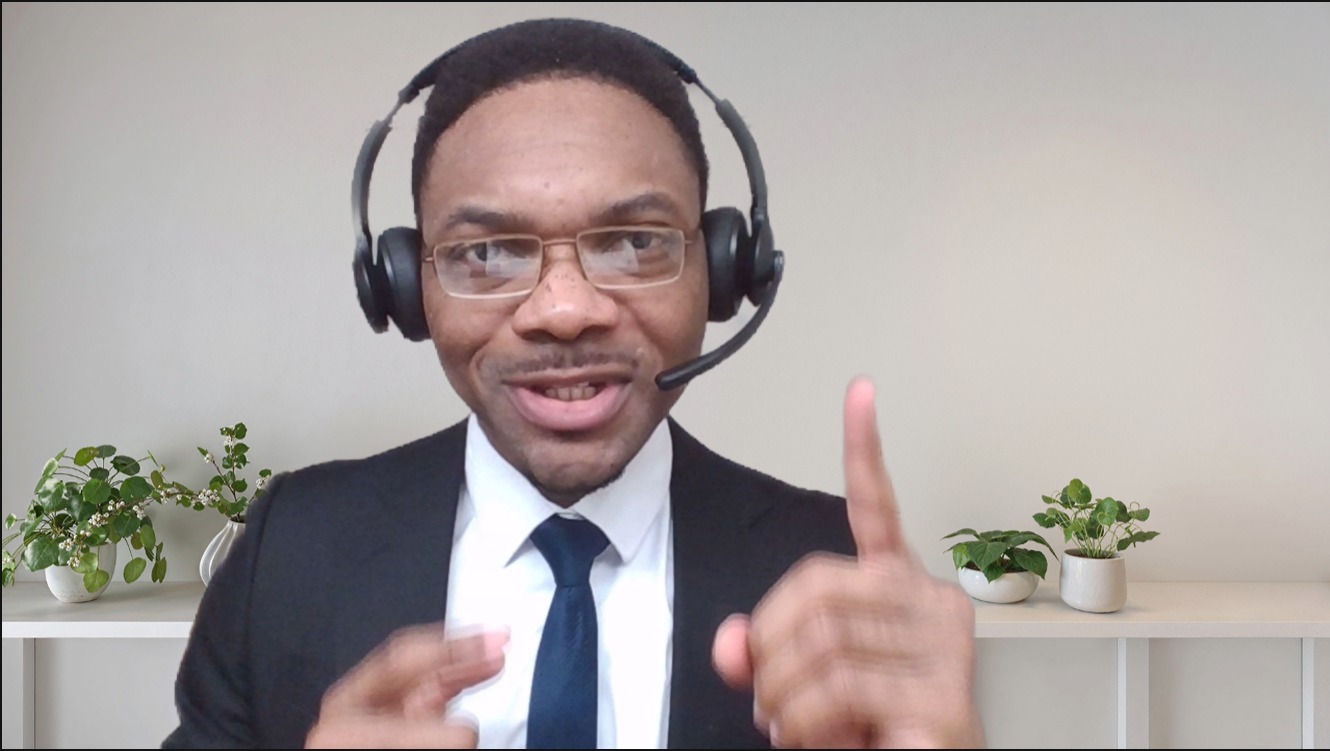

Speaking at the workshop, the Chairman, of Noor Takaful Insurance Limited, Muhtar Bakare highlighted the role Takaful Insurance plays in managing the increasing level of uncertainty in business operations, noting that the firm provides support when necessary and promotes collaboration and equity in business operations.

Bakare explained that the Takaful model, which operates on the ‘Sharia principles of empathy and fairness’, offers an affordable window of inclusion to millions of Nigerians who have hitherto been excluded from the formal financial sectors.

“The alternative finance sector of which Takaful Insurance is a major sub-sector which presents credible routes to stability through alternative models of economic management and delivery of financial services to create more sustainable and inclusive growth”.

While applauding the regulator, partners as well as participants for their support for the company, Bakare assured that the underwriter would continue to take all the necessary steps to meet its obligations and commitments to clients and other stakeholders.

In the same vein, the Chairman, Oyo State Muslim Community, Alhaji Kunle Sanni, represented by Barrister Rasheed Attah, explained that the Takaful model remains an insurance option for Nigerians as it is guided by ethics, equity, and fairness as well as regulated by the National Insurance Commission (NAICOM).

Also speaking, the Vice-Chairman, Noor Takaful Insurance Limited, Aminu Tukur stated that the company is excited to bring Takaful insurance to Ibadan, stating that the firm would continue to drive massive awareness and ensure that the products become widely acceptable among Nigerians including non-muslims.

Speaking during the panel session, the Rector of CIFM, Dr. Yeside Oyetayo who attributed the challenges facing the insurance sector in Nigeria to lack of awareness and trust, also described Takaful as an alternative option in addressing various challenges people encounter in the process of accessing insurance products given the ethics guiding its operations.

While commending Noor Takaful for their outstanding contribution to advancing the cause of ethical insurance in Nigeria, she urged the company to give priority to designing products for women to accelerate financial inclusion.

“Statistics have shown that 67.8 per cent of women in Oyo state are financially excluded. This is quite alarming because Ibadan women are known to be enterprising. I think Noor Takaful needs to have insurance provided for women. In doing this, you need to do market research to find out what they truly need rather than coming up with generic products, ” she said.