• Projects economy to record headwinds in Q4 2020, Q1 2021

• Projects economy to record headwinds in Q4 2020, Q1 2021

• U.S. election outcome to influence financial markets, global oil prices

Nigeria, Africa’s largest economy began the Fourth Quarter (Q4), facing some of the biggest protests ever witnessed since the military rule ended in 1999.

As the protests boiled over, amid an already turbulent period, not only in the local but global economy, the cumulative effects of the COVID-19 pandemic lockdowns and other restrictions triggered a downturn, together with a sharp increase in public debt.

Given the resulting uncertainty from the protests, financial markets were spooked once again with the strong knock-on effects, hitting Nigeria’s stock market and international bond, while further clouding its economic outlook.

Before this development, the International Monetary Fund (IMF) projected a 4.3 per cent contraction in Nigeria’s Gross Domestic Product (GDP), given to the impact of the pandemic on the economy.

Senior Research Analyst at FXTM, Lukman Otunuga, said the depressed oil prices enduring a prolonged lapse in demand had not helped matters, especially as the outcome of the protests were projected to cost over N700 billion in output, which may drag on real GDP.

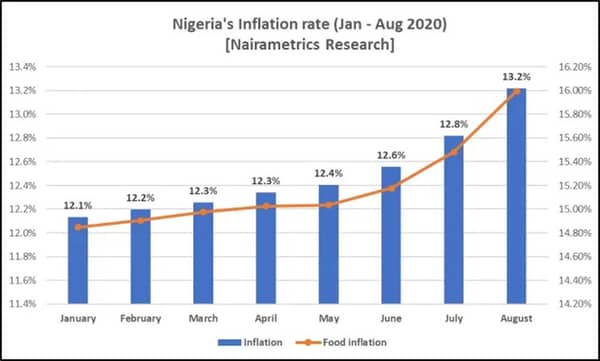

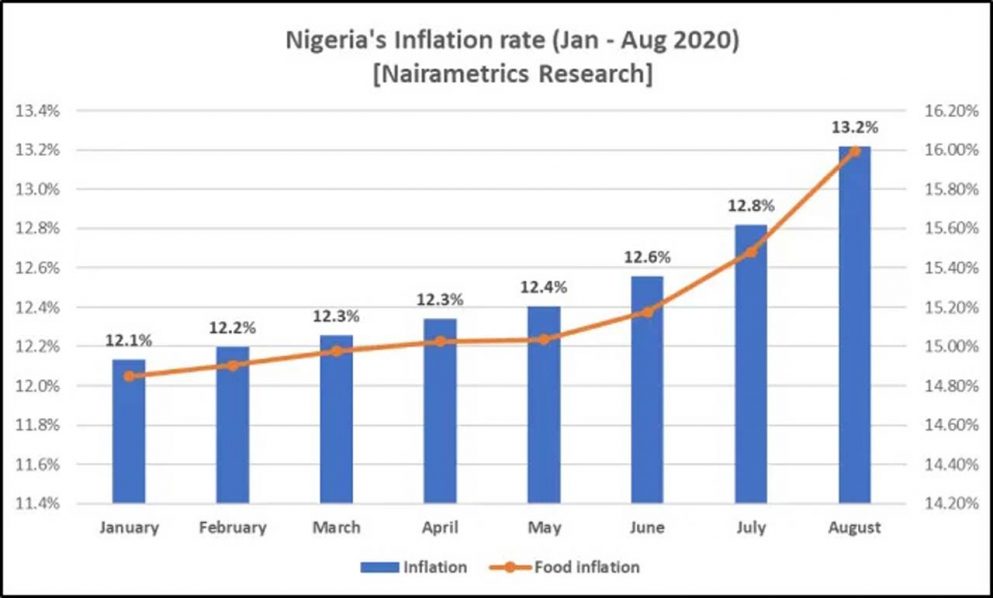

He said the rising public debt, together with inflation have become a cause for concern, as Nigeria has witnessed three consecutive quarters of rising inflationary pressures, shaky economic fundamentals, Dollar scarcity, and low oil prices.

According to him, the curfews imposed on Lagos, worsened the outlook for the already fragile economic landscape and local businesses, which bore the marks of deep wounds from COVID-19.

He said: “Inflation rose for 13 months straight, hitting 13.71 per cent in September. Price increases were seen mainly in medical treatment, electricity, food supplies and passenger air travel, but so far, have not impacted the oil industry.

“This was a welcome development given that oil accounts for over 90 per cent of export earnings and 70 per cent of government revenues.

“Focusing on the Naira, the banking system clamped down on speculation and limited foreign exchange transactions by individuals and corporations. The intention was to stabilise the currency, which was at the centre of a perfect storm of low oil prices, Dollar scarcity, and a weaker economy.”

Meanwhile, he said external pressures, like the presidential elections in the United States, added to the uncertainty prevailing around Nigeria’s economic outlook, especially the oil prices.

“According to national polls, Democrat challenger, Joe Biden, was leading the incumbent Donald Trump, but electoral polls are the kind of forecast that can change last minute. Whatever the political race’s outcome, the result is critical for the U.S. and global economy, and may heavily influence the financial markets.

“When it comes to oil, Trump’s policy of backing the U.S. Shale industry and ramping up U.S. oil production may fall by the wayside if Biden wins the election. In turn, this could pressure global oil prices and send them even lower,” Otunuga added.

He argued that the downside scenario might weigh on Nigeria’s economy, in spite of its efforts to diversify and reduce its reliance on the oil industry, noting that a Trump win might increase oil markets’ confidence in the short term, while in the medium term; COVID-19 remained the main problem for oil demand.

Meanwhile he projected that Nigeria’s economy would face unprecedented headwinds in the fourth quarter (Q4) of 2020, and in Q1’2021.

He said the challenge would be to get through the storm of a weakened economy facing internal and external threats, and reaching a place where there would be smoother sailing.

“Now more than ever, it is important to keep diversifying the economy, and make provisions for a calmer future where Nigeria can recover from its recent trials,” he said.