• FG to fund N553.46b budget gap with spectrum fees, maritime tax

• Security to gulp 13.4 per cent of total expenditure outlay

• Education allocation raised from 5.4% to 8.2%

• Only N1.88b released for capital projects as at November

• Govt not doing enough to generate income, says expert

For 11 months, last year (January to November), the Federal Government spent a staggering N5.24 trillion servicing its debt obligations to different local, as well as foreign institutions and individuals.

This came as the government looks forward to accumulating a fresh N8.8 trillion debt from domestic and international markets to implement its ambitious 2023 budget.

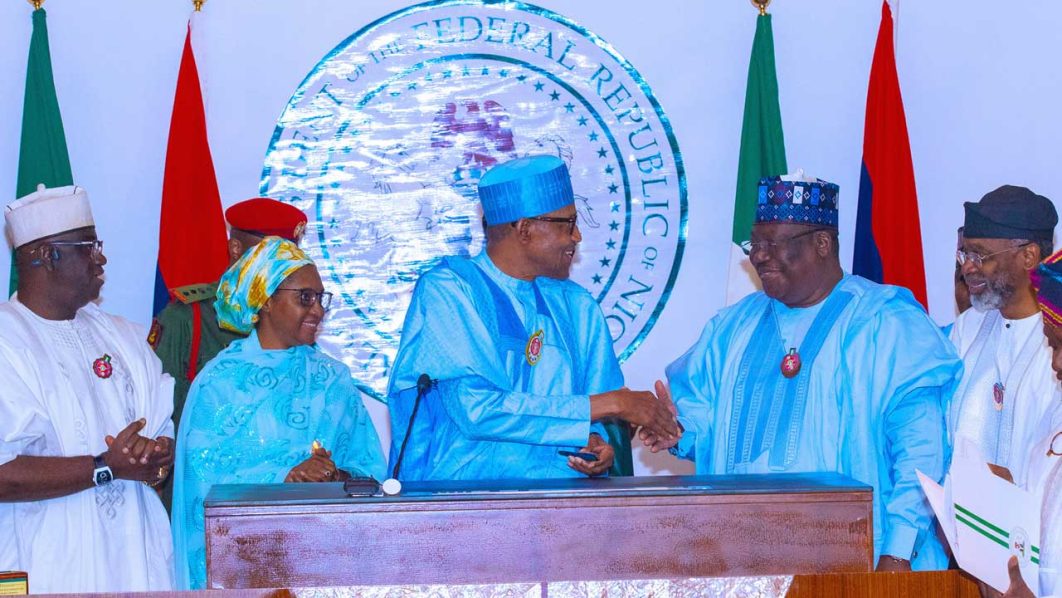

Recall that President Muhammadu Buhari, on Tuesday, signed into law the 2023 Appropriation Bill, mapping out a total spending outlay of N21.83 trillion. Of the total expenditure, N553.46 billion stood out as unfunded deficit, with the President informing Nigerians that Minister of Finance, Budget and National Planning, Zainab Ahmed, would meet with National Assembly members to reconcile obvious discrepancies in the appropriation.

While presenting the breakdown in Abuja, yesterday, the minister said the unfunded amount would be sourced from spectrum fees and tax on the maritime sector. After the first tranche of inflow from spectrum licensing, the government is expecting $273.6 million (about N123 billion) from a fresh 5G auction later in the year.

The 2023 appropriation, which Prof. Pat Utomi, a political economist, described as a “budget of debt servicing”, has a deficit of N11.34 trillion, coming at a time the national debt has surpassed N44 trillion plus the yet-to-be-securitised N22.7 trillion ways and means facility extended by the Central Bank of Nigeria (CBN).

According to the finance minister, government intends to source N7.04 trillion from the domestic market, a decision that could have a huge crowding out effect on private investment and subsequently trigger job losses.

The government will explore the foreign market for N1.76 trillion debt and draw down another N1.77 trillion from existing bilateral and multilateral facilities, while the balance (N206.18 billion) will come from privatisation proceeds.

The government is cashing on its revenue reform to achieve an equity funding of 48 per cent, which amounts to N10.49 trillion. The target is a tall order considering the recent year performance of the government’s revenue projections.

Last year’s 11-month actual earned revenue was N6.5 trillion, putting the estimated annualised performance at N7 trillion or 33 per cent short of this year’s projection. Experts have, rightly, dismissed the target as unrealistic.

Frivolous projections, inadequate earnings from crude oil sales and lack of creativity in the government circle are seen as some of the factors that will hamper implementation of the 2023 budget.

The 2022 11-month budget performance laid by the finance minister said the government spent a total of 12.87 trillion as at end of last November, as against N6.5 trillion it earned, putting the fiscal deficit at N6.39 trillion. With passage of the supplementary budget, the projected deficit is put at N8.17 trillion.

Sadly, only N1.88 billion was released for capital expenditure as of November while personnel cost (inclusive of pensions) accounted for N3.94 trillion of the spending mix.

In the face of deficit shock, the government has allocated a working N228.1 billion to what Ahmed described as lawmakers’ severance and inauguration without providing clarity on what, in the two items, gets what. If half of the amount goes into paying off the legislators, a member will get N243.17 million on average.

On the bright side, the education sector enjoys a larger percentage this year as it moves to 8.2 per cent from the 5.39 per cent it received in 2022.

A total of N1.79 trillion (translating to 8.2 per cent of the total budget) was spread across the Federal Ministry of Education, Universal Basic Education, Tertiary Education Trust Fund (TetFund) and others.

The education sector got 7.9 per cent of the 2016 budget. In 2017, it was 6.13 per cent, and 7.14 and 7.12 per cent in 2018 and 2019 respectively.

“The projected fiscal outcome in the 2023 budget is based on the PMS subsidy reform scenario. In the 2023 budget framework, it is assumed that the petrol subsidy will remain up until mid-2023 based on the 18-month extension announced in early 2022. In this regard, only N3.36 trillion has been provided for PMS subsidy. There will be tighter enforcement of the performance management framework for GOEs that will significantly increase operating surplus/dividend remittances in 2023,” the minister said.

Ahmed also laid out the underlying assumptions, saying: “The oil price benchmark is set at $75 per barrel. Some of the parameters underlying the 2023 projections deviate from those in the National Development Plan (NDP) 2021-2025. They have been updated based on a combination of current realities and a modified medium-term outlook.

“The inflation rate is projected to average 17.16 per cent in 2023, and 14.93 per cent is projected in the NDP for 2023.

“In the 2023 budget framework, it is assumed that PMS subsidy will remain up to mid-2023 based on the 18-month extension announced in early 2022. In this regard, only N3.36 trillion has been provided for PMS subsidy.”

The minister hinted that Nigeria is not planning on restructuring its debt, but remains committed to meeting its domestic and external debt obligations.

However, she was quick to explain that government will continue to utilise appropriate debt management tools to streamline the cost and risk profile in the debt portfolio, including through concessional loans, spreading out of debt maturities to avoid bunching, and re-profiling of the debt maturities by refinancing short-term debt using long-term debt instruments.

The breakdown also indicated that INEC will get N173.6 billion; the National Judicial Institute (NJI), N165 billion; N119.9 billion will go to the NDDC; UBEC will spend N103.3 billion while NASENI gets N51.6 billion for the current year.

The defence recurrent and capital expenditure will gulp N2.98 trillion, which represents 13.4 per cent of the budget.

About N1.24 trillion, which is 5.7 per cent of the budget, goes to infrastructure, comprising works and housing, power, transport, water resources and aviation. A total 3.7 per cent of the budget, which translates to N809.32 billion, will be spent on social investments and poverty reduction programmes.

While picking holes in the budget details, the Chief Executive Officer of Dairy Hills Limited, Kelvin Emmanuel, observed that the 2023 Appropriation Act that was delayed for three months to allow for implementation of a supplementary budget is a classic example of pure fiction.

He held that proposing total funding of 43 per cent from oil and non-oil revenues and 57 per cent from debt, at a time of $100 oil prices, and above $30 gas prices per million metric standard cubic feet, is proof that the Buhari government spent eight years in office doing nothing to advance the position of public finance in terms of improving the revenue to GDP ratio.

He equally held that proposing amendments to the finance bill that will see the Corporate Income Tax of upstream oil companies rise from 30 per cent to 50 per cent for flaring gas without a force majeure event, is proof that the Federal Executive Council does not realise that International Oil Companies (IOCs) are handicapped from maximising the benefits of capturing gas from wellheads as a result of insufficient midstream off-takers who are not incentivised for investing in gas-gathering infrastructure.

Emmanuel maintained that the 2023 budget looks like one prepared by government workers who lack understanding on how businesses operate and how policy implementation can unlock value.

He wondered why N8.8 trillion in the 2023 budget has to be raised through debt financing at a time when the government is borrowing at 18 per cent in bond yields with a lower investment grade. He said this is yet another proof that the budget office is continuing a fiscal strategy that relies principally on borrowings as a means for plugging deficit.

He further held that a 40 per cent debt financing funding structure means the Federal Government will continue using Quantitative Easing as a means for funding deficits. This is coming at the same time when the Senate has rejected the proposal of the President to allow DMO to restructure outstanding loans that currently stand at $52 billion, or 133 per cent of Nigeria’s external foreign reserves.

Lead Director of Centre for Social Justice (CSJ), Eze Onyekpere, said the budget arrives at a time Nigeria is facing existential challenges.

He said it is unfortunate that from a budget of over N21 trillion, all Nigeria hopes to get in terms of revenue is less than N10 trillion.

“That means we have close to N12 trillion in deficit financing. This is against a debt scenario of over N44 trillion. Again, recall the N22 trillion in ways and means from the CBN, which the President has sought to reconstruct to a bond, which the National Assembly refused, given the provisions of the CBN Act,” he said.

Onyekpere said the headwinds are quite strong against the economy and full implementation of the budget.

According to him, “the economic environment is not looking friendly. Most of us are simply looking beyond Buhari to see who will come in and how he will re-engineer the economy because the Buhari administration is already a lost case.”