• Only 2.6% of imports from China funded with Yuan swap auction in four years

• ‘Naira volatility, a major drawback in future negotiation’

• China accounts for over 25 per cent of Nigeria’s imports

• Trade value climbs to N19.57tr since MoU was first signed

• Currency exchange good deal but time for ‘house cleaning’, says Owoh

Four years into the Nigeria-China currency exchange programme, trade and currency sale data suggest the deal is barely scratching the surface of the huge illiquidity hurdle importers must surmount to lift goods from the global manufacturing hub.

As at end of the second quarter, and a year into renewal of the CNY16 billion bilateral currency swap, the total amount of yuan auctioned by the Central Bank of Nigeria (CBN) from inception was CNY7.044 billion.

Indeed, demand for the US dollar has remained stronger, owing to several factors, some of which include multiple conversions involved in international trade due to dollar benchmarking, weak local currency and high preference for the dollar over other currencies.

CBN’s 2022 Financial Market Half-Year Report disclosed that a total of CNY1.263 billion was sold in 13 auctions in H1 2022, compared with CNY1.217 billion sold in 13 auctions in the first half of 2021. Plus other previous auctions, since the programme kicked off, the apex bank had sold CNY7.044 billion as at the end of June.

The performance status report of the programme for the second half is not ready but experts said it might not be remarkably different from historical data.

The total amount sold in advancement of the bilateral deal is less than the value of the deal, which was intensely negotiated for two years before the much-publicised contract signing by heads of the monetary authorities of the two countries on April 27, 2018.

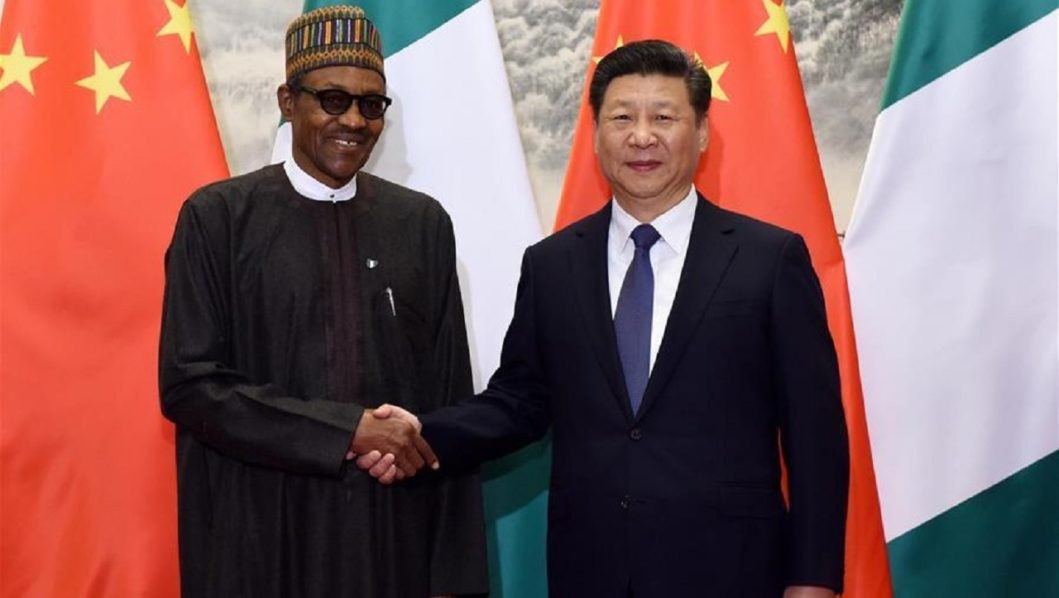

Led by the Governor, Godwin Emefiele, officials of the CBN and the Peoples Bank of China (PBoC), led by their boss, Dr. Yi Gang, were locked in painstaking negotiations for over two years before a memorandum of understanding (MoU) was signed in Beijing, an event described as a game changer in the search for headway in the FX liquidity crisis.

“The transaction, which is valued at Renminbi (RMB) 16 billion or the equivalent of about $2.5 billion, is aimed at providing adequate local currency liquidity to Nigerian and Chinese industrialists and other businesses, thereby, reducing difficulties encountered in the search for third currencies,” the CBN had said.

Among others, officials of the apex bank said the swap would provide naira liquidity to Chinese businesses and provide RMB liquidity to Nigerian businesses, respectively, thereby improving the speed, convenience and volume of transactions between the two countries.

The Renminbi processed and sold under the currency swap agreement could only fund 2.6 per cent of the value of goods Chinese companies sold to Nigerians. The amount, in the same strength, was about two per cent of the total value of trade between Nigeria and China. The currency swap contract value (CNY16 billion) does not seem to take into full consideration the volume of Nigeria-China trade, to realistically reduce the illiquidity concern.

A comprehensive naira-yuan arrangement could reduce the FX need for physical goods importation by as much as over 20 per cent. In Q3 2022, China alone accounted for 26.95 per cent of the total import bills, estimated at N5.67 trillion.

Of this figure, only N365.9 billion was settled in dollars. But importers had to first source for dollars (the primary currency of trade) and convert to currencies of other countries to complete transactions. The multiple conversions involved in international trade due to dollar benchmarking, coupled with attendant increase in transaction cost, is a major glitch that currency exchange arrangements are meant to eliminate.

The value and volume of foreign trade between the two countries, indeed, has grown. But the expansion has been one-sided and driven by China’s imbalanced global trade. While Nigeria’s leakages have increased tremendously, depriving local manufacturers of the opportunity to leverage the huge market to create jobs for the army of jobless youths, China continues to rake in trillions of naira from the Nigerian market.

Nigeria’s quarterly exports to China have fallen by 13 per cent between when the MoU took off and the end of H1 2022. The figure, in naira terms, dropped from N81.87 billion in Q3 2018 to N71.11 billion in Q2 2022.

Extended to last quarter, which is the most recent trade data publicly accessible, Nigeria’s exports to the Asian giant have fallen by 28.4 per cent. The monetary value of the country’s total exports to China in Q3 2022 was N58.6 billion.

Nigeria’s export growth is far slower (now in the negative territory) than the country’s moderate 3.3 per cent quarter-on-quarter (q/q) average growth in imports in the period. The import figure rose from N4.85 trillion in Q3 2018 to N7.4 trillion in Q2 2022. The Nigeria-China export performance has earned the worst growth among other Asian trading partners.

For example, export to Japan rose by over 100 per cent, from N45.45 billion in Q3 2018 to N109.2 billion in Q2 2022, while that of India, the country’s historical top trading partner (in export), jumped by over 47 per cent, from N764.9 billion to N1.1 trillion in Q2 2022. Driven by Japan and India, Nigeria’s exports to Asia ballooned over twofold to N1.15 trillion in the period.

Whereas the value of exports has dipped, Nigeria’s bills on imports from China remain upbeat, growing from N591.4 billion in Q3 2018 to over N1.5 trillion in Q3 2022. That translates to approximately 158 per cent uptrend. The expansion outstripped the 34 per cent growth across the entire import spending in the same period.

In the 16 quarters the CBN sold CNY7.044 billion to Nigerian importers, the country’s total imports from the Asian power, according to foreign trade data provided by the National Bureau of Statistics (NBS), was estimated at N17.11 trillion or 26 per cent of the N69.64 trillion spent on imported goods.

The top four Nigeria import partners – China, the Netherlands, India and Belgium – accounted for 52.35 per cent of import bills. That suggests that comprehensive (in principle) currency swap with only four countries could ease dollar liquidity by as much as N2.97 trillion.

But currency swap negotiation is not a tea party and could be extremely cumbersome, as demonstrated by the Nigeria-China deal. Speaking on this, David Adonri, an investment banker and economist, said the financial derivative could relieve pressure on FX but added that a country with extremely volatile currency could find it difficult to bring a counterparty to a deal-signing table.

“You must locate a counterparty in the foreign country who needs your currency to strike a deal. However, if your currency is extremely volatile, it may be difficult to find a counterparty,” Adonri told The Guardian.

Indeed, volatility risk could be a major drawback, should Nigeria begin negotiation, except the country agrees to future settlement in the prevailing exchange rate, which is one approach to settlement.

The naira performance underpins the seriousness of the challenge. When the MoU was signed, the Chinese Renminbi was trading for N48. It was relatively stable all through the first phase of the deal. But today, the naira has lost about one-tenth of its value to the Chinese currency in the past year.

Could currency swap make a difference in the country’s search for exchange crisis management options? Dr. Chiwuike Uba, a development economist and financial management expert, said it would. But he believes there are more fundamental economic challenges begging for attention.

“Naturally, currency swap should relieve pressure on foreign exchange, particularly when such agreements are concluded with major trading partners. Unfortunately, based on available data, this is not the case with the currency swap agreement between Nigeria and the People’s Bank of China (PBoC).

“The implication is that the purported currency swap is not functional as intended. Therefore, signing a currency swap agreement is not an issue. At least, we have witnessed more forex pressure after the signing of the currency swap agreement, instead of an improvement in our forex exchange. It is clear that there are fundamental drawbacks to some of these policies and interventions that are not publicly available,” Uba stated.

The economist decried the overwhelming role of the black market in the country’s FX transactions, saying the underlying challenges in the market must be fixed, if other innovative add-ons would make any difference and bring real value.

According to him, currency swap, at the moment, is an academic exercise that might not alleviate pressure on the naira. He argued: “Currently, over 95 per cent of FX for imports for traders, manufacturers and others are obtained from the parallel market, despite the currency swap. Why should those who import goods from China abandon the existing currency swap platform for the parallel market?

“Except China, India, South Korea and the United Arab Emirates, the rest of the top 10 countries in total imports are the United States, United Kingdom and European countries, and they account for 31.51 per cent of the 72.73 percentage share of the top 10 countries in total imports.

“On the other hand, European countries represent 36.6 per cent share of the top 10 countries in total exports. The United States represents 5.66 per cent, India (10.44 per cent), Indonesia (seven per cent), South Africa (4.83 per cent) and Ivory Coast (4.52 per cent). It is evident from the foregoing that it might be difficult to mitigate the current forex pressure by entering into currency swap with the European Central Bank (ECB) and the United States.

“I will, therefore, encourage the government and every Nigerian to focus more on addressing the fundamental challenges we face in foreign exchange by being more productive.

We need to get factories working again to increase export products, including other interventions to stimulate forex. I do not think currency swap agreements with our major export and import partners are going to alleviate the pressure on forex.”

Godwin Owoh, a professor of applied economics, thinks currency swap would address a reasonable part of the challenges Nigerians have had to cope with, on account of FX scarcity. But he insisted that for an administration that has been able to deliver on many of its promises in the past seven years, it is time for “house cleaning”.

Besides, he believes China and other economies are more diligent in probing facts behind the figures than Nigeria. Hence, he said, it would be extremely difficult for Nigeria to gain an advantage in any bilateral contract entered with the countries.