The relationship between accounting, auditing, and sustainability has become increasingly pivotal in today’s rapidly evolving economic landscape, particularly within public and hybrid organisations.

The relationship between accounting, auditing, and sustainability has become increasingly pivotal in today’s rapidly evolving economic landscape, particularly within public and hybrid organisations.

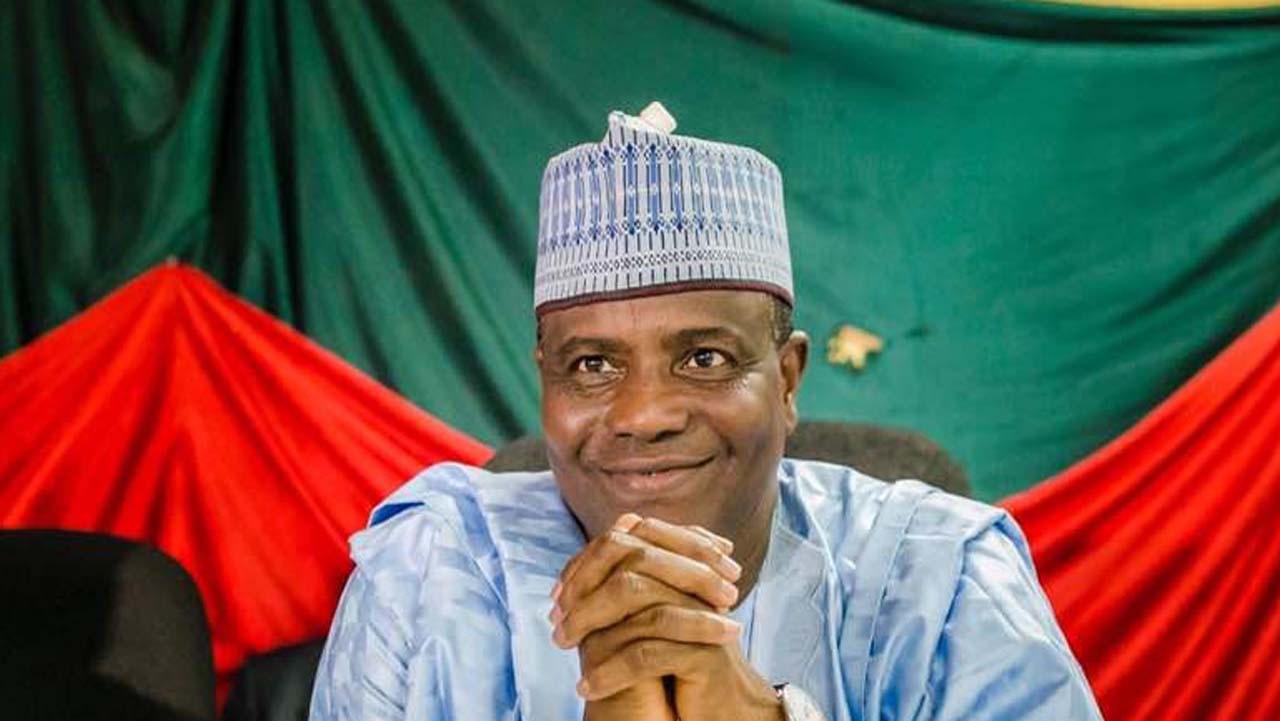

These entities, according to Victor Oritsegbemi Omaghomi, a UK-based management consultant and certified accountant with extensive experience in operational efficiency and financial processes, are characterised by their blend of public sector objectives and private sector efficiency, operate within a unique framework that demands a careful balancing act between financial accountability and sustainable development.

Accordingly, he says as global awareness of environmental and social issues intensifies, accounting and auditing play an increasingly crucial role in promoting sustainability within these organisations.

Consequently, Omaghomi in his paper says accounting in public and hybrid organisations transcends traditional financial reporting. It is not merely about documenting financial transactions or ensuring regulatory compliance but encompasses a broader perspective that integrates economic, environmental, and social dimensions.

This holistic approach, according to him often referred to as sustainability accounting, aims to provide a more comprehensive view of an organisation’s performance. It involves the meticulous recording and reporting of financial and non-financial information, enabling stakeholders to make informed decisions that align with long-term sustainability goals.

Omaghomi, who excels in business strategy and stakeholder management, said one of the primary challenges in sustainability accounting is the identification and measurement of non-financial metrics. Unlike financial data, which is standardised and quantifiable, sustainability metrics often involve qualitative aspects that are difficult to quantify. These may include factors such as carbon footprint, water usage, employee welfare, community engagement, and ethical practices.

“The development and implementation of standardised frameworks, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), have been instrumental in addressing this challenge. These frameworks provide guidelines for organisations to systematically measure, manage, and report their sustainability performance.

“The GRI framework, for instance, offers comprehensive reporting standards that help organisations understand and communicate their impacts on critical sustainability issues. It covers a wide range of topics, including climate change, human rights, governance, and social well-being. By adhering to GRI standards, organisations can enhance transparency and accountability, which are critical for building stakeholder trust and ensuring long-term sustainability.’’

Similarly, Omaghomi, who holds a Master’s degree from the University of Hertfordshire and a Bachelor’s degree in Accounting from Bowen University said the SASB provides a set of industry-specific standards that identify the sustainability issues most likely to impact financial performance.

These standards guide organisations in disclosing financially material sustainability information to investors. By focusing on materiality, the SASB standards help organisations prioritise the sustainability issues that are most relevant to their business and stakeholders.

Adopting these frameworks for the Association of National Accountants of Nigeria (ANAN) can significantly enhance sustainability accounting practices within Nigeria. In his article, the management consultant says by implementing GRI and SASB standards, Nigerian organisations can achieve several key benefits:

Enhanced transparency and accountability: These frameworks enable organisations to provide clear and consistent sustainability reports, making it easier for stakeholders, including investors, regulators, and the public, to assess their sustainability performance.

Improved decision-making: Standardised sustainability metrics allow organisations to make more informed decisions by understanding their operations’ broader impacts, leading to better resource allocation, risk management, and strategic planning.

Increased investor confidence: Investors increasingly consider sustainability factors in their investment decisions. By adopting recognised sustainability standards, Nigerian organisations can attract more investment by demonstrating their commitment to sustainable practices and long-term value creation.

Compliance with international standards: Adhering to globally recognised frameworks like GRI and SASB helps Nigerian organisations align with international best practices and facilitate access to global markets, partnerships, and funding opportunities.

Positive social and environmental impact: By systematically measuring and managing sustainability performance, organisations can reduce their negative environmental and societal impacts and contribute to national and global sustainability goals, such as the United Nations Sustainable Development Goals (SDGs).

Governmental policies and regulations he says often drive sustainability integration into public organisations’ accounting practices. Governments worldwide are increasingly mandating the inclusion of sustainability reports in annual financial disclosures.

For instance, the European Union’s Non-Financial Reporting Directive (NFRD) requires large public-interest entities to disclose information on environmental, social, and employee matters, respect for human rights, and anti-corruption measures. Such regulations enhance transparency and compel organisations to adopt sustainable practices as part of their operational strategies.

Hybrid organisations operating at the intersection of the public and private sectors face unique challenges and opportunities in sustainability accounting.

These entities, the certified accountant says often pursue dual objectives of financial profitability and social impact. Consequently, their accounting practices must reflect this duality, accurately representing financial performance and social value creation.

The triple bottom line concept, which emphasises the simultaneous pursuit of economic, environmental, and social goals, is particularly relevant in this context. By adopting this approach, hybrid organisations can demonstrate their commitment to sustainability while maintaining financial viability.

“Auditing, as a complementary function to accounting, is critical in ensuring the reliability and integrity of sustainability reports. Traditional auditing practices that primarily focus on financial statements must evolve to encompass sustainability audits. This involves the verification of non-financial information and the assessment of an organisation’s sustainability practices and performance.

Independent audits objectively evaluate an organisation’s adherence to sustainability standards, thereby enhancing credibility and stakeholder trust.

“The practice of sustainability auditing is still in its nascent stages, and several challenges persist. One of the primary issues is the need for universally accepted auditing standards for sustainability reports. While frameworks like the GRI and SASB provide guidelines for sustainability reporting, the auditing process requires a more robust and standardised approach.

Developing comprehensive auditing standards akin to the International Financial Reporting Standards (IFRS) for financial reporting is essential to ensure consistency and comparability across organisations and industries.

“Furthermore, the complexity and diversity of sustainability issues pose significant challenges for auditors. Unlike financial audits, which rely on established accounting principles and methodologies, sustainability audits involve various environmental, social, and governance (ESG) factors.

Auditors must understand these diverse issues profoundly and have the skills and expertise to evaluate them effectively, necessitating ongoing training and professional development to keep pace with the evolving sustainability landscape.”

The increasing emphasis on sustainability in public and hybrid organisations also underscores the need for integrated reporting. Traditional financial reports often provide a fragmented view of an organisation’s performance, focusing solely on economic aspects. Integrated reporting, on the other hand, combines financial and non-financial information into a cohesive narrative.

This approach offers a holistic view of an organisation’s impact and value creation.

Towards this end, the International Integrated Reporting Council (IIRC) has been promoting integrated reporting, advocating for a comprehensive framework that encompasses financial, environmental, social, and governance information. Integrated reporting enhances transparency and facilitates better decision-making by stakeholders.

Investors, customers, employees, and other stakeholders increasingly consider sustainability factors in their decision-making processes. Integrated reporting enables stakeholders to make informed decisions that align with their values and objectives by providing a comprehensive and transparent view of an organisation’s performance.

Therefore, the intersection of accounting, auditing, and sustainability in public and hybrid organisations raises important questions about accountability and governance. Effective governance structures are crucial in integrating sustainability objectives into these organisations’ core operations and decision-making processes. This approach involves establishing clear policies and procedures, assigning responsibilities, and implementing robust monitoring and evaluation mechanisms.

Boards of directors and senior management will continue to play an integral role in championing sustainability initiatives and fostering a culture of accountability by setting the tone at the top, demonstrating a genuine commitment to sustainability, and embedding it into the organisational ethos.

This strategy includes setting ambitious sustainability targets, allocating resources for sustainability initiatives, and regularly reviewing progress towards these goals.

Transparent communication and stakeholder engagement are also vital to building trust and ensuring that sustainability efforts align with stakeholder expectations.

Finally, the certified accountant says integrating accounting, auditing, and sustainability in public and hybrid organisations is complex yet essential. As the global community grapples with pressing environmental and social challenges, public and private organisations are pivotal in driving sustainable development. Public and hybrid organisations can enhance transparency, accountability, and stakeholder trust by adopting comprehensive sustainability accounting practices, conducting rigorous sustainability audits, and embracing integrated reporting.

Moreover, effective governance and leadership are crucial to embed sustainability into the organisational DNA and ensure long-term value creation. As we move towards a more sustainable future, the synergy between accounting, auditing, and sustainability will be instrumental in shaping the path forward for public and hybrid organisations.

Akindayomi is a Lagos-based Economist.