Given the mortality rate of businesses in Nigeria, any business concern that can operate profitably in the country for just a decade could rightly be regarded as possessing superpowers, to put it literally.

So, for a company that started from the bottom over 30 years ago and now tops the oil and gas sector pyramid in Nigeria, it will ordinarily not be out of place to give Oando Energy its flowers. Unfortunately, before the world, some people are bent on rewriting history, nay the Oando story.

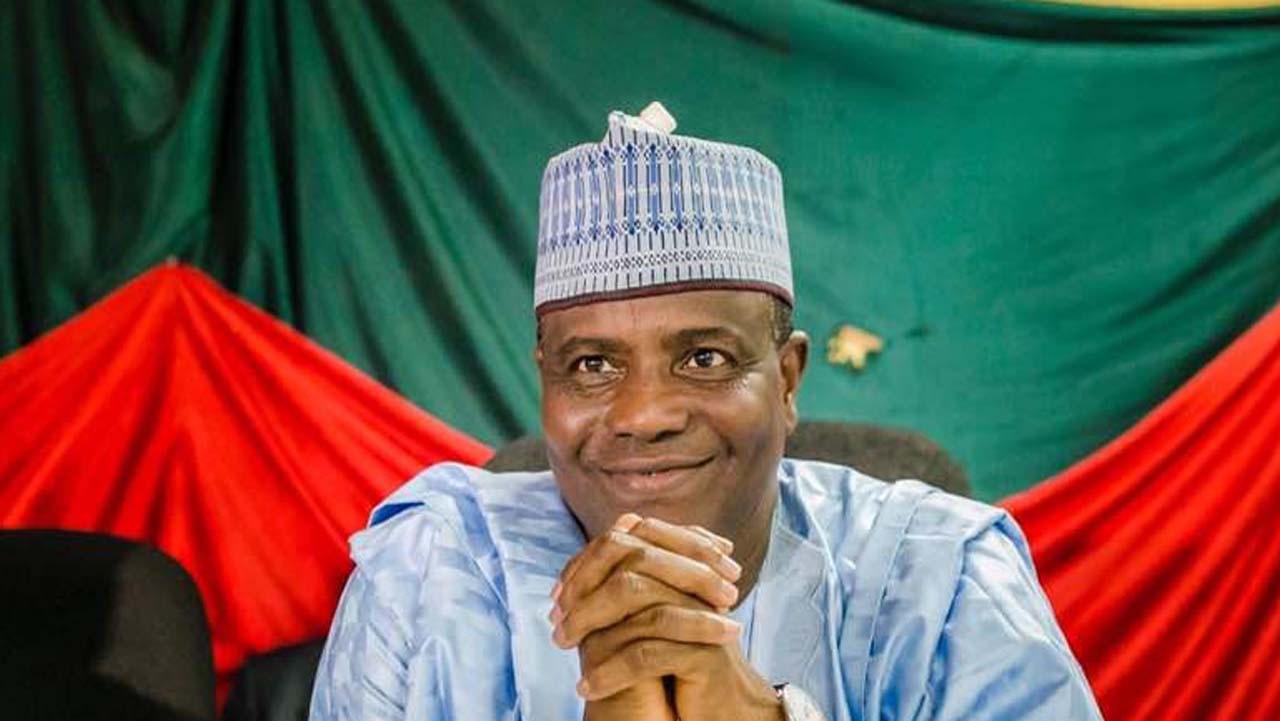

For some time, there have been various public narratives on Oando and its Group Chief Executive Officer, Wale Tinubu, which have practically turned facts on their head.

Not the least of these imputations is that the Wale Tinubu-led Oando is being favoured by the government because of his familial relationship with the current Nigerian leader, Bola Tinubu.

Coloured in politics, the recent seeming attacks on Oando’s business operations vis-à-vis its acquisition and thereafter divestment in OVH as well as its acquisition of Nigerian Agip Oil Company (NAOC), have been nothing but baseless.

As it is, the facts do not support the perception in certain quarters, especially sentiments expressed by former Vice President Atiku Abubakar that the company is thriving as a result of the undue favour it is getting from the Bola Tinubu administration.

This is because the Oando story did not start with the current government. There were other landmark achievements, including several acquisitions by the company before the Tinubu administration, which is barely 16 months old.

But these forces have continued to push the flawed narrative that the Oando Plc chief executive is being favoured in his business acquisitions by the government because the president is his uncle.

Oando is sub-Saharan Africa’s foremost indigenous energy group with a primary listing on the Nigerian Stock Exchange and a cross-border listing on the Johannesburg Stock Exchange.

Its story goes back to 1956 when ESSO West Africa Incorporated, a petroleum marketing subsidiary of Exxon Corporation, which was then acquired by the federal government in 1976 and rebranded as Unipetrol Nigeria Limited. This eventually gave birth to Oando. The real transformative journey of Oando began with the establishment of Ocean and Oil Services Limited, whose focus was on the supply and trade of petroleum products both locally and internationally.

In 2000, Ocean and Oil Holdings acquired a 30 per cent controlling interest in Unipetrol, later increasing it to 42 per cent in 2001. Following a further acquisition of a 60 per cent stake in Agip Nigeria Plc in 2002, Unipetrol and Agip Nigeria were merged in 2003, resulting in the formation of Oando.

Over the next decade, Oando subsequently built the largest indigenous integrated energy company in Sub-Saharan Africa. These comprised Oando Marketing Limited, one of the largest downstream petroleum marketing companies in Nigeria with over 500 retail outlets across Nigeria, Ghana, and Togo.

There’s also Oando Supply and Trading Limited, incorporated in 2004, one of the largest independent traders of crude and refined petroleum products in sub-Saharan Africa.

Besides, Oando Gas & Power Limited incorporated in 2004, is a pioneer in the development of Nigeria’s foremost gas distribution network, spanning 264km and serving over 150 industrial and commercial customers in Lagos, Calabar and Port Harcourt.

Oando Energy Services Limited incorporated in 2005 is Nigeria’s largest indigenous oilfield services provider, enhancing indigenous participation with a fleet of five rigs while Oando Energy Resources is regarded as one of Nigeria’s foremost indigenous upstream oil and gas companies.

On its oil and gas upstream journey, this commenced 20 years ago, when in 2004, the company secured a 42.75 per cent interest in the marginal field, Oil Mining Licence (OML) 56. Subsequently, in 2007, it acquired a 15 per cent stake in OML 125 & OML 134.

Hungry for further success, in 2008, Oando acquired a 30 per cent interest in the Akepo marginal field, OML 90. This continued in 2009, when it further acquired an 81.5 per cent interest in Equator Exploration Limited, while in 2012, the Company was awarded 100 per cent in Blocks in Sao Tome EEZ.

In 2014, the company achieved a significant milestone by acquiring ConocoPhillips Nigerian assets for $1.8 billion, inclusive of working capital, securing a 20 per cent interest in the NAOC-Joint Venture.

It augmented its total net 2P reserves to 503 million barrels of oil equivalent (mmboe), with peak net production levels of 45,000 barrels of oil equivalent per day (kboep/d).

In 2016, the company made a strategic decision, to divest from its naira-earning businesses and to focus on its dollar-earning portfolio, resulting in the phased sale of its interest in the downstream between 2016 to 2019, and its stake in the midstream in 2017.

Besides, in 2021, Oando Clean Energy Limited was established to design and deliver clean energy projects towards the realisation of the nation’s energy requirements and the United Nation’s Race to Net Zero.

Now a big player in the industry, in August 2024, 10 years after the purchase of ConocoPhillips Nigerian assets, Oando completed the acquisition of 100 per cent of Eni’s interest in NAOC, the operating company of the JV, further increasing its stake in the JV from 20 per cent to 40 per cent, securing operatorship of the JV and doubling its 2P reserves to 996.2 mmboe.

This acquisition also resulted in the expansion of the company’s exploratory asset base portfolio. Today, the company’s strategic focus lies on expanding its dollar-earning portfolio and positioning itself for the energy transition through the development of its renewable energy business.

This significant milestone of the successful acquisition of Eni’s Nigerian subsidiary, NAOC for $783 million, achieved in a signing ceremony in London, marked a new era for the Nigerian energy sector, describing it as a watershed moment for indigenous oil and gas players.

Sixty-eight years after the discovery of oil in Oloibiri, Oando is now poised to lead and operate oil and gas assets previously dominated by International Oil Companies (IOCs) in Nigeria.

Despite the thorough trashing of the allegations by the former vice president, which also included alleged underhand dealings in the NNPC’s acquisition of OVH, the matter continues to take some space in public discourse.

According to Atiku, the retention of Mr. Mele Kyari as the Group Chief Executive Officer of NNPC was compensation for the alleged acquisition of NNPC Retail Ltd by OVH in which he claimed Mr Wale Tinubu held a 49 per cent stake.He further alleged that the NNPC Retail and OVH acquisition deal was part of a grand scheme by Tinubu to integrate his business interests into Nigeria’s public enterprises at the federal level.

Separately, the 2023 Peoples Democratic Party (PDP) presidential candidate, challenged the government to clarify how Oando Plc allegedly received accelerated approval to acquire the onshore assets of NAOC.

But those who should know better, especially government agencies in the sector have come out to explain why other divestment deals slowed down and why the Oando transaction appeared to have been faster compared to those ones.

For instance, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) in an explanatory note, said the approval of the divestment deal between Oando and NAOC followed due process and was done in compliance with existing regulations.

As for the divestment by Mobil Producing Nigeria Unlimited (MPNU) to Seplat Energy Offshore Limited (Seplat), referenced by Atiku, the statement noted that it was undergoing the same consent approval process and is expected to be completed within the 120-day timeline provided by the Petroleum Industry Act (PIA).

“It is worth pointing out that NNPC’s right to pre-emption and consent under the NNPCL/MPNU Joint Venture Joint Operating Agreement was the subject of Suit No: FCT/HC/BW/173/2022 NNPC versus Mobil Producing Nigeria Unlimited, Mobil Development Nigeria Inc., Mobil Exploration Nigeria Inc. and NUPRC,” it added.

On OVH, the NNPC sought to push back on allegations by Atiku that the president as well as Wale Tinubu had underhand dealings in the national oil company’s acquisition of OVH.

Contrary to the “false alarm” raised, the NNPC stated that neither Wale Tinubu nor the president has any interest in the OVH acquisition, stressing that the process of renaming OVH NNPC Retail after its acquisition was ongoing.

As it is today, the post-merger renaming had been completed, meaning that OVH Energy Marketing Limited is now NNPC Retail Limited and this has been accepted by the Corporate Affairs Commission (CAC).

Indeed, it is only those who do not know Wale Tinubu well that will insinuate that he will push to get anything done on a platter. That would be very much unlike him.

Wale has never been a pushover. From all available pointers, Bola Tinubu was not the president when Wale acquired those aforementioned assets spanning decades.

Many can still remember Mofe Boyo alongside JiteOkoloko who along with Wale Tinubu birthed what has today become the energy sector behemoth to beat. These three musketeers became the poster boys of the privatisationprogramme then.

Wale started early school in Nigeria before proceeding to the University of Liverpool, England for his tertiary studies where he earned a bachelor’s degree in law (LLB). Subsequently, he went to the London School of Economics where he bagged a master’s degree (LLM) specialising in International Business Law in 1989 and was called to the Nigerian Bar in 1990.

He began his career in 1990 as a legal practitioner and later achieved a track record as a serial energy entrepreneur with a proven reputation in building energy companies and institutions.

An astute business leader, and a visionary with a track record of having raised over $4 billion from international financiers for various growth, acquisitions, and development projects. He sits on the board of various companies.

In 1993, he co-founded Ocean & Oil Group leading its growth from an oil trading and shipping company to a fully diversified Oil & Gas Company. In 2000, Ocean & Oil acquired a controlling interest in Unipetrol PLC and two years later, he led the largest-ever acquisition of a quoted Nigerian company, with Unipetrol PLC’s purchase of Agip Nig PLC, thereafter rebranded as Oando.He is globally recognised for the successful transformation of Oando from a petroleum marketing company to sub-Saharan Africa’s foremost integrated energy group.

Under his leadership, Oando Marketing became the nation’s leading distributor of petroleum products with a network of over 130,000MT tank storage capacity and over 400 retail outlets.

He also pioneered the construction of a state-of-the-art mid-stream jetty designed to eliminate operational inefficiencies in petroleum product importation, resulting in millions of dollars in cost savings for the industry.

For Oando Gas and Power, he developed the nation’s foremost natural gas distribution company with circa 300km of gas pipelines delivering cleaner energy to over 150 commercial customers in Lagos, Calabar and Port-Harcourt.

In 2014, he completed the $1.8 billion landmark acquisition of Conoco Phillips Nigerian businesses, fortifying the company as one of the largest indigenous oil & gas companies in Nigeria.

Today, OER has interests in 15 licenses with extensive infrastructure across the Niger Delta & West Africa in addition to being a strategic national gas supplier as it is the 2nd largest gas supplier to the LNG and the domestic market as well as being a dominant power supplier to the nation via its Okpai Power Plant Phase 1 & 2.

He was conferred with the National honour of Commander of the Order of the Niger (C.O.N) in October 2022 and is the recipient of numerous other national & international awards.

Read the rest of this article on www.guardian.ng

Akinwale, an analyst wrote from Lagos.