Data released by the Nigeria Inter-Bank Settlement System (NIBSS) has put Bank Verification Number (BVN) enrolments in Nigeria as of December at 67.8 million.

The new figure, released yesterday, showed a growth of 4.3 million from 63.5 million recorded in 2024, which showed significant progress in the uptake of biometric identification in the financial sector.

Specifically, NIBSS data put the figure in the last five years as follows: 2021 (51.9 million), 2022 (56 million), 2023 (60.1 million), 2024 (63.5 million) and 2025 (67.8 million).

The growth trajectory showed a 6.8 per cent year-on-year increase between 2024 and 2025, sustaining the database’s upward trajectory amid broader financial inclusion efforts.

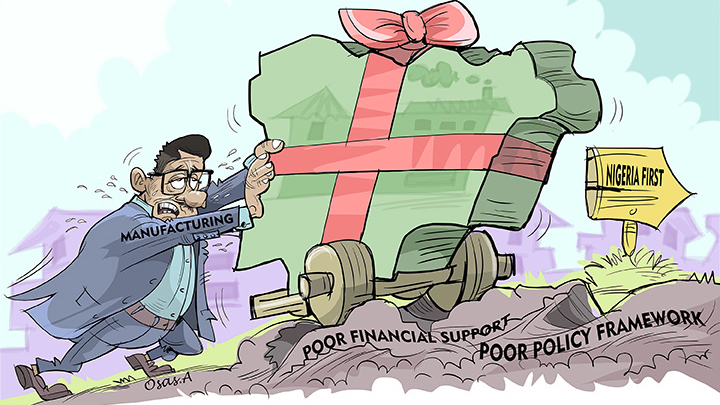

The rise in BVN enrolments through 2025 is closely linked to policy interventions and enforcement directives by the Central Bank of Nigeria (CBN).

As of August 2025, data from NIBSS put active bank accounts in Nigeria at 325.6 million. The number is high because it includes all different types of accounts (savings, current and corporate) held by all customers across all banks.

It should be noted that some customers gave multiple accounts.

Recall that the BVN in Nigeria is one of the ambitious digital transformations, driven by the CBN and the Bankers’ Committee.

The BVN was launched on February 14, 2014. The BVN initiative was a crucial response to the increasing challenge of identity fraud and the need for a uniform identity system across the Nigerian banking sector.

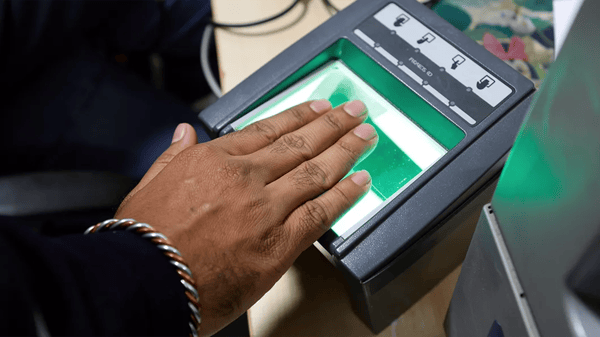

According to the CBN, the primary goal was simple, precisely to give every bank customer an 11-digit unique identity tied to their biometric data, their fingerprints and facial image.

Analysts see this biometric security as the most robust defence against identity theft, which conventional password and PIN systems have struggled to contain.

The enrolment process was straightforward, where customers were required to visit any branch of their bank, fill out a form, and present themselves for biometric capture. After a verification period, usually within 24 to 48 hours, the unique BVN would be generated and sent via SMS. This single BVN would then be linked to all of the customer’s accounts across all Nigerian banks, unifying their financial identity.