An underwriting firm, Royal Exchange Plc, has reaffirmed its commitment to delivering sustainable long-term value to shareholders, following a strong financial performance that signaled a turnaround in its operations for the 2024 financial year.

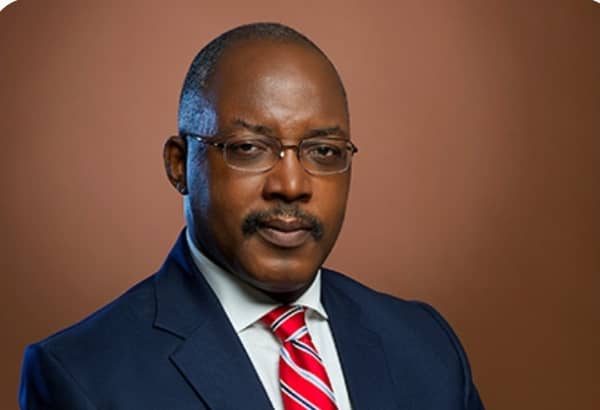

Speaking at the company’s 56th general meeting in Lagos, Chairman of the board, Kenny Ezenwani Odogwu, said the group remained focused on consolidating growth, improving profitability, and leveraging its diversified investment portfolio to create enduring shareholder value.

“The insurer remains focused on two key objectives: consolidating our asset management expertise by driving growth and profitability across our investee companies, and leveraging strategically repositioned portfolio to ensure long-term value creation,” Odogwu stated.

According to him, the group’s financial results for the year ended December 31, 2024, reflected solid growth across key indicators despite the tough macroeconomic environment.

The company’s net income rose by 133 per cent, from N767 million in 2023 to N1.7 billion in 2024, driven largely by improved investment income and profit contributions from associate companies. Total expenses dropped by 24 per cent, from N969 million to N728 million within the same period, while profit before tax stood at N1.04 billion.

Odogwu attributed the performance to prudent financial management, operational discipline, and strategic diversification that helped the group weather multiple economic headwinds, including the removal of fuel subsidy, exchange rate volatility, and broader market instability.

“The underwriter boasts a robust liquidity position and healthy cash flow, which provide flexibility for future investment opportunities,” he added, “We remain dedicated to capitalizing on market opportunities and general sustainable value for shareholders.”

The chairman described the 2024 financial year as a period of strategic repositioning and recovery, noting that the group’s positive results underscored the effectiveness of its turnaround strategy and strengthened fundamentals.