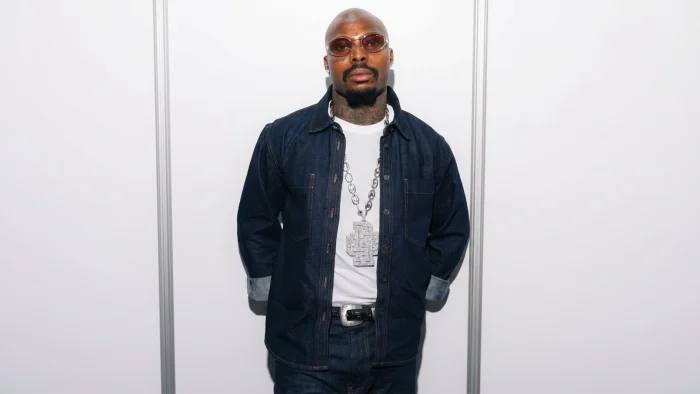

Prior to the appointment of Arc. Ahmed Musa Dangiwa as the Managing Director/Chief Executive Officer of the Federal Mortgage Bank of Nigeria in 2017, the Nigerian housing sector had been facing serious challenges that appeared insurmountable.

[ad]

Immediately he assumed office, Dangiwa embarked on revolutionary moves that changed the face of housing in the nation, and his legacies will obviously stand the test of time.

Ahmed Musa Dangiwa is an example of the wisdom of putting a round peg in a round hole when it comes to appointing people to run national institutions.

This came from his over 30 years in the real estate and infrastructure development sectors, which enabled him to have specific ideas about the challenges of providing affordable housing to Nigerians and how to meet these challenges.

“We have provided over 9,000 houses, and have provided mortgages worth more than N110 billion within the last three years,” he said with relish after spending some years in office.

He continued: “Apart from that, we have also created a micro finance loan, which is given to individuals, especially to renovate their house.”

Supervising several outstanding projects in diverse areas and sectors across the country opened his eyes to the enormity of the nation’s housing deficits.

Dangiwa knows why people are reluctant to go for the mortgage option in addressing their housing needs. He once said that a civil servant cannot pay 30 percent equity for a house, which is what is on offer in commercial banks. So he led FMBN to come up with a drastic policy.

“So we had to reduce the equity to 10 percent for a house that he has to buy for N10 million. The equity for houses between N5-10 million was reduced to 10 percent. With that I was able to get more mortgage for Nigerians, especially the low and middle income earners, and some in the informal sector.”

One of the challenges in the housing sector that he grappled with is “how to make affordable mortgages more accessible, and even if you have to provide mortgages, there have to be underlining houses.

[ad]

“Most of the houses I met were those built by developers, who sourced their funding basically from open markets at high interest rates, high cost of land, and other costs, which majorly increases the cost of houses.”

To address the issue of affordability, especially among civil servants, he said: “We had to enhance our construction panels in such a way that you will have to provide construction panels for developers, to give them affordable interest rates to create affordable houses and then we give mortgages.”

Innovations

When he assumed leadership of FMBN, he realised that many of the houses that banks had built were not subscribed because people could not access them due to their equities being too high. “So we created another programme called ‘Rent to Own.’ With this, subscribers approach FMBN offices in the states, who will give them access to the house as tenants. While living in the houses as tenants, they pay either monthly or annual rents until the houses become theirs.”

Dangiwa also brought an insurance scheme to the mortgage housing sector. In the event that the house is destroyed by a storm, rain or other causes, insurance will be there to cover the loss and you, whose insurance also covers the eventuality of death, paying up the house on behalf of the deceased’s family.

Another innovation that Dangiwa introduced is the use of certificates of occupancy (C of O) for lands. “Instead of them buying houses, we can give them individual construction loans to build the houses at their own pace on any location the land is situated,” he explained. “Money is given to subscribers in 3 phases — 30 percent to start it; we give you 30 percent to roof it and the remaining 40 percent for finishing.”

He identified land availability as one of the major constraints to the delivery of housing, due to the stringent conditions state governments attach to allocation of land. He noted that “some government agencies take a lot of time to issue C of O. State governments have to ensure that they make access to land easy and they also have to make it easy for estate developers. Governments have to make sure that even if the lands are subsidised, there should be access roads into the land.”

Other ground-breaking milestones recorded by the FMBN Management under Dangiwa include zero equity contribution for mortgage loans that are N5million and below, reduction of equity for loans of up to N15million from 30 to 10 percent as well as increased tempo in the provision of housing loans to Nigerian workers under the National Housing Fund (NHF).

Under Dangiwa, FMBN’s increased nation-wide public sensitisation programme, high-level engagements with stakeholders including state governments, labour unions and other housing industry persons, and increased transparency saw the increase in workers who contribute 2.5 per cent of the monthly salaries to NHF scheme rise above five million, thus, expanding the pool of finance available to the FMBN.

Notably, the bank pooled a total of N134 billion from the NHF within three years, with N121 billion in loan approvals. This implied an average of N44 billion in total contributions per year! The difference is stark when compared to total collections of N232 billion between 1992 and 2016 at a yearly average of N9.6bn.

The astonishing improvements recorded by the Dangiwa-led team within three years are significant in the history of housing development in Nigeria at a two fundamental levels.

[ad]

One, they provided solid proof that the often-criticised NHF Scheme, despite its sub-optimal impact in the first two decades of its establishment, is indeed, a good and viable scheme for catalysing affordable home delivery. Two, they show that the scheme possesses great potential to act as impact as an institutional enabler of affordable housing delivery and above all, under the right type of leadership.

The strides signaled what is possible and should encourage the government and relevant industry stakeholders to support and encourage the current management to sustain the momentum. As the main fulcrum of FMBN’s activities, the NHF supports the bank’s suite of affordable housing loans that target a critical segment of the population i.e. workers who fall within the low- and medium-income brackets. Provisioned at terms and conditions that are unrivalled in the market, FMBN’s products currently stack at the top as the average Nigerian worker’s best route to affordable housing

From a very unique perspective, therefore, Dangiwa understood why developers build expensive houses. He links this to limited funds available to them. “First and foremost, they got the lands at very high costs – as high as 25 to 30 percent. In banks, they give construction finance at 25-30 percent interest rate, but here we give construction finance to developers at 10 percent, so we have reduced in such away that constructions done by developers for FMBN subscribers are meant to be more affordable.”

From a very unique perspective, therefore, Dangiwa understood why developers build expensive houses. He links this to limited funds available to them. “First and foremost, they got the lands at very high costs – as high as 25 to 30 percent. In banks, they give construction finance at 25-30 percent interest rate, but here we give construction finance to developers at 10 percent, so we have reduced in such away that constructions done by developers for FMBN subscribers are meant to be more affordable.”

He also highlighted the need for the federal government to strengthen institutions that are into affordable housing.

Dangiwa spearheaded N500billion recapitalisation drive of the bank to boost its capacity to create affordable mortgages, which has received federal government and stakeholder wide support.

FMBN sent a memo to FEC for the required N500 billion. However, Dangiwa explained that the bank was not expecting this to be made available in a fell swoop. Realistically, it was looking for N200billion as equity contribution from the government, while N300 billion were to be sourced from investors who wanted to invest in FMBN.

“Even the N200 billion does not have to come at once; it can be in two tranches, because we know the government has other priorities. But the point needs to be stressed that housing is also a priority, because it is one of the social responsibilities of the government to ensure that citizens have access to houses,” he said.

[ad]

Dangiwa severally appealed to critics of the pace at which the government is implementing its affordable housing policy, vis-à-vis the need to subsidise the scheme, to “calm down.”

He admonished: “We should understand that there are no countries that have succeeded in providing affordable houses to its citizens without subsidy, which is very important to strengthen the institutions that are responsible for doing that. If institutions such as ours are not strengthened to function properly, it is going to be difficult for them.”

In addition to worrying about the challenges of providing houses to the masses, Dangiwa sought to address the welfare of FMBN staff.

He recalled: “When we came on board, we found out low morale at work for which many factors are responsible. There are people who are given housing loans, but you find out that their rental income is too low for even senior staff to own houses even on the outskirts of Abuja. So, we had to make sure that their rental allowances were increased by 100 percent. And we discovered that most staff have stayed for 10 years without promotion. So, we had to promote staff, to motivate them to do better.”

He also implemented a programme of inclusion, when he found out that in the bank, there were some staff that were employed as casual staff. “I met 276 of such casual staff, who were denied permanent employment by the previous leadership. They kept on picking and using people as casual staff, some of whom were graduates, on a monthly salary of N40,000.”

Dangiwa also effected decentralisation of the bank’s operations. Of this he said: “Through decentralisation, states now have the right to process and recommend for disbursement to head office, so they do the checks and balances and send to the head office.”

As a result, the bank disbursed over N 31 billion in the past three years, compared to the disbursement within the previous 25 years of the bank from (1992 to 2017), which was only N10 billion.

Before he took over the reins, most of FMBN’s operations were carried out manually. “Before, you only had a passbook and when you contribute; you didn’t even know what you were contributing,” he recalls. This did not help transparency and accountability. Now, many of its operations have been digitised. With just dialing *219#, customers can transact a lot of their businesses with the bank.

Noteworthy is the disbursement of a total of N169.8billion in housing loans within the four years, representing a 111 per cent increase over the N152billion that was disbursed since the NHF scheme was established 25 years ago.

Dangiwa also opened a new vista of innovative home loans that are designed to create a good fit between what the bank is offering and the income capacity of workers who subscribe to the NHF scheme.

Housing Challenges In Nigeria

For many Nigerians, access to decent and affordable housing remains a critical challenge. The housing challenge is especially exacerbated by the rise in rural-urban migration, which continues to stretch the limited public infrastructure in urban centres.

The depth of the challenge is already quite clear, according to the International Human Rights commission IHRC, more than 28 million Nigerians lack access to decent and affordable housing, and this is in tandem with the estimates of the Federal Mortgage Bank of Nigeria (FMBN), which project that Nigeria requires at least 28 million housing units to close the Housing gap.

However, the challenge did not start today; Nigeria’s housing deficit has grown progressively from 7 million housing units in 1991 to 12 million in 2007, 14 million in 2010 and subsequently 28 million housing units in 2022. The combination of a growing urban population, lack of an efficient mortgage system, poverty, increasing construction costs, high inflation and declining household income, have made access to decent and affordable housing difficult for many Nigerians.

The Central Bank of Nigeria in 2019, note that only 10 per cent of Nigerians who desire to own a home can afford it. When compared to 72 per cent in the United States and 78 per cent in the United Kingdom, the estimate is largely inadequate for the size of our economy.

Despite the enormity of the housing challenge, there is a lot that suggests Nigeria can turn the tide around, close the housing deficit and steadily provide for the country’s needs.

The Federal Mortgage Bank of Nigeria (FMBN) estimates that N21trn will be required to close the housing gap. This clearly suggests that the government cannot address the challenge alone and that only a collaboration between the government and private sector players will be adequate.

There is no doubt that Nigeria must aspire to close its housing gap within the shortest time possible. While the government has a major role to play, only private sector-led investment provides the capital that can guarantee the level of investment that is required to close the gap and clear the deficit.

• Qudus Kola Balogun is the Chairman of Chiocestone Capital Limited

[ad]