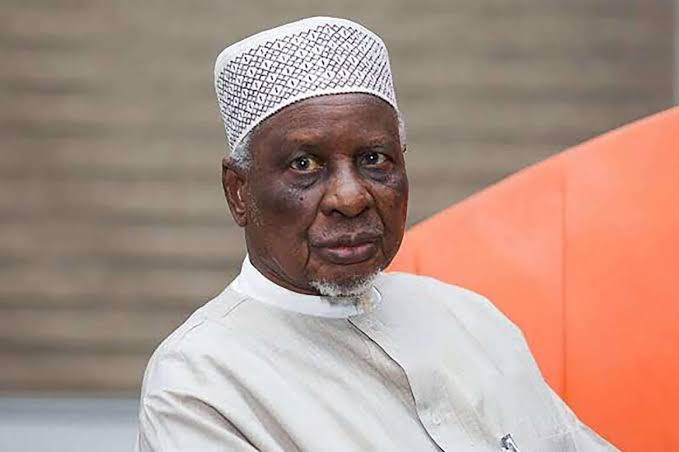

The Central Bank of Nigeria (CBN) governor, Godwin Emefiele, on Tuesday apologised to Nigerians for the failed online transactions.

Emefiele admitted challenges faced by bank customers following the limit on cash withdrawals and said the CBN would sustain the current monetary regime following a rise in headline inflation which posed significant risks to the economy.

He said this just as the Monetary Policy Committee (MPC) of the central bank, resolved to raise the Monetary Policy Rate (MPR) otherwise known as an interest rate by 50 basis points to 18 percent from 17.5 per cent.

“I must apologise. Yes, online channels fail. But no doubt it is as a result of the deluge of online transactions that hit the banking industry. But it is being resolved,” Emefiele said while addressing journalists at the end of the two-day meeting of the committee in Abuja.

“On a daily basis, our Payment System Management Department monitor the online payment platforms so as to make sure that when there is a downtime, they are quickly resolved so that transactions can go on smoothly.”

Emefiele assured that all Nigerian banks are safe due to the existing prudential guidelines instituted by the CBN to protect banks against collapse that will wipe out depositors’ money.

He added that “no depositor has lost one kobo since 2008 from bank crisis because of the prudential guidelines put in place to protect depositors fund”.

The CBN governor warned bank shareholders to be mindful of the fact that “banking licence is a privilege and not a right as it can be withdrawn if shareholders misbehave.

“We would rather dispense with the shareholders than put depositors money at risk.”

[ad unit=2]