• 100,000 motorists compete for 58 stations

• 100,000 motorists compete for 58 stations

• Marketers battle with N1.2tr funding gap as cars outnumber stations

• Trucks spend two days queuing as NARTO seeks urgent intervention

Over 100,000 motorists who converted their fuel-powered vehicles to compressed natural gas (CNG) are now enduring long queues nationwide as they compete at scanty stations to refill their cars.

With only about 34 CNG stations available across the country while motorists move to convert their vehicles to run-on gas to reduce the astronomical costs of petrol, approximately 870 vehicles are currently tied to a station.

Marketers, who seem to be indifferent in betting their money on the market told The Guardian that CNG being totally new would require an initial investment of N1.2 trillion to increase stations from the 58 stations to 1,000 as each facility costs over N1 billion to be constructed.

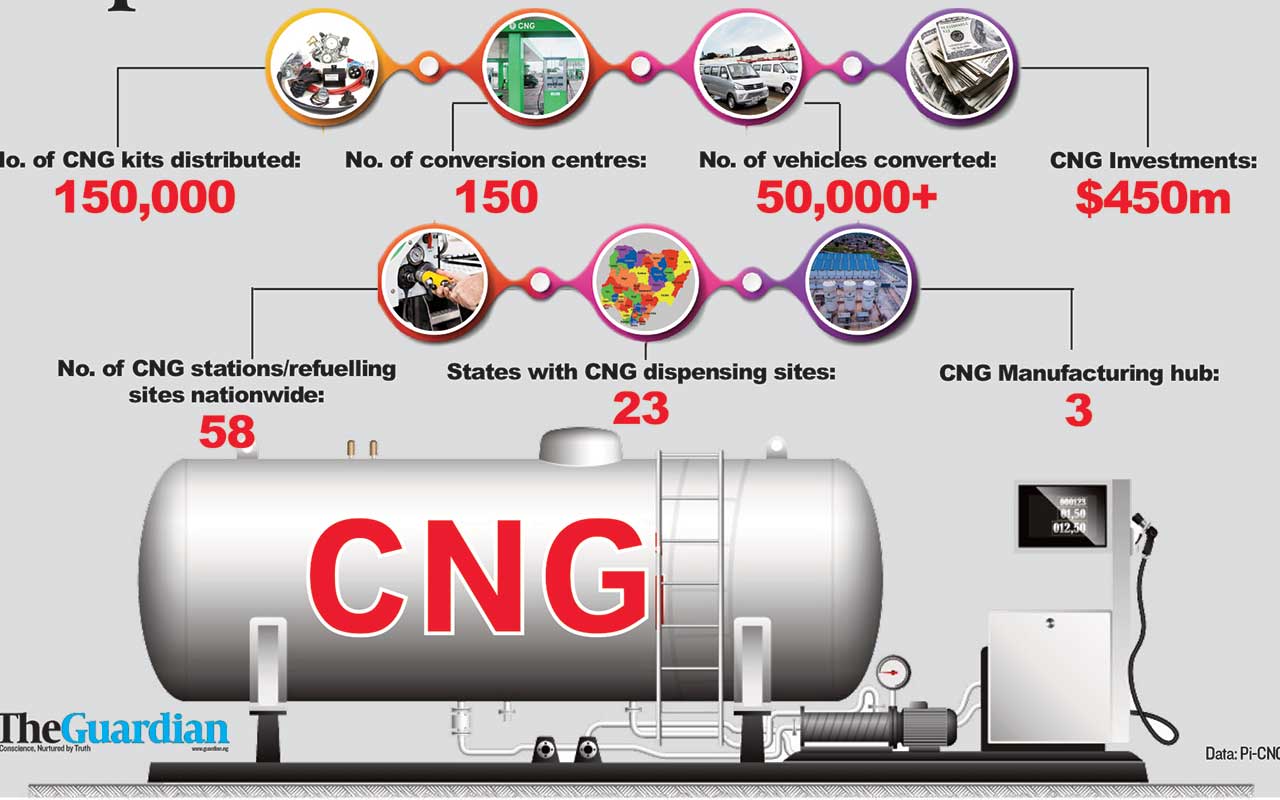

Data from the Federal Government showed that the auto CNG industry in 2023 spanned only five states with less than 4,000 vehicles in operation. The adoption has since improved with over 50,000 CNG vehicles including trucks and mass transit buses now operating across 15 states with conversion centres now over 150 nationwide.

The Presidential Initiative on CNG also noted that over $450 million has been invested in conversion, refuelling and training, adding that one million vehicles and over $3 billion would be achieved in two years.

Meanwhile, the fiscal incentives are not motivating enough, a reason the growth of infrastructure is at snail speed. At the current growth, it may take the country more than a year to double the number of stations in operation, The Guardian learnt.

In Abuja, most of the much-hyped NNPC retail outlets that should be dispensing CNG do not with the few NIPCO outlets crowded, forcing motorists to spend about six hours in queues daily.

Truck owners, who have now defaced the Airport Road in the capital city spend at least two days before reprieve. This comes amidst calls for the need to address safety issues just as some countries are looking at phasing out natural gas vehicles.

With the 34 refilling stations, which are only present in Edo, Abuja, Lagos, Kogi, Ogun and Oyo states, stakeholders are worried about the length of time it would take for the infrastructure to spread to the northern region and most parts of the South-South and South-East where some of the 138 conversion centres created by the government are located.

With the exponential increase in the price of PMS under the current government, President Bola Tinubu told Nigerians that CNG was the right way to go as the scheme, which the Federal Government is heavily funding, is billed to save the country about N2 trillion in petrol import bills.

Amidst criticism, an energy expert, Dan Kunle, said the President only bought into the idea of some of his close allies. With most defenders of the initiative coming from India, Nigeria is currently struggling with the move because the infrastructure for CNG unlike LPG is relatively new in Nigeria and would need gradual investment.

Most stakeholders are worried that unless projects like the Ajaokuta Kaduna Kano pipeline project and OB3 are in place, the initiative may only thrive in the western part of Nigeria, warning that the more people embrace it, the longer the queues would become.

For most CNG users with small cylinders of 65 kilogrammes, the cost of refilling is about N2,000. That usually takes an average car about 100 kilometres to drive before it is back to the station for refill.

Most commercial motorists in Lagos and Abuja refill about three to four times daily. Some motorists said they spend as much as four hours in queues.

An e-hailing driver, Victor Okorowa sees the CNG initiative as a game-changer in business profitability but noted that a major limitation is that unavailable gas has made a mess of the prospect.

“Gas is good but most stations are not selling. NIPCO sells every day while the NNPC CNG stations rarely work. Most times they don’t have gas. Only the station at Gaduwa has been consistent, but the place is in lockdown because of the queue,” Okorowa.

The taxi driver was spending N30,000 daily to make N20,000 profit. With gas, he spends N6,000 daily and makes about N34,000 profit, according to him.

Another commercial driver, Usman Ali, said he returned to the station, which is far from the city centre, after every three hours. Left for the crisis in getting CNG, he said, it is a cheaper option to expensive PMS.

A private vehicle owner, Roland Olarewaju, who was in the queue at one of the retail outlets in Abuja said unless the retail outlets are readily available, the benefits of the scheme would not be a mirage. He expressed worry over the ‘Nigeria factor’ that may compromise the conversion process and maintenance of the infrastructure. An energy expert, Kunle, raised concerns about the feasibility and practicality of the CNG in Nigeria, emphasising that the challenges in developing adequate infrastructure and managing upstream production would affect the programme.

Kunle outlined a range of factors that could hinder the effective deployment of CNG across Nigeria, suggesting that current plans lack the necessary market foundation and could ultimately sideline essential issues such as education, healthcare and clean water.

According to him, setting up CNG infrastructure is far more complex than many may realise, with critical dependencies on how much natural gas is produced daily, who processes it into CNG and the associated costs from the wellhead to retail outlets.

“Nigeria faces significant crude oil and gas production challenges due to low investment and poor management of upstream assets,” Kunle said.

He questioned how CNG could feasibly replace petrol or contribute to poverty reduction and decarbonisation given these constraints.

Kunle further criticised the designation of CNG as a presidential initiative, noting that previous energy projects like the Presidential Power Initiative with Siemens have seen limited success.

He urged President Tinubu to allow private oil and gas investors to decide, based on thorough market research, if CNG truly represents the most economically viable energy solution for Nigeria.

“We need to prioritise where investment will have the greatest impact,” Kunle stated, stressing that allowing private-sector-led decision-making could lead to a more balanced and rational energy mix strategy for the country.

Director of Presidential CNG Initiative (PCNGI), Michael Oluwagbemi, disclosed that since the launch of the Presidential CNG Initiative, over 100,000 vehicles have been converted from petrol to CNG/biofuel.

He said investors were ramping up the development and deployment of CNG infrastructure, with over $200 million already invested across the value chain.

An industry expert, Joseph Zone, said there is a lack of comprehensive infrastructure for CNG deployment, adding that while gas has been used globally for over 30 years, Nigeria is only exploring it at a time when many countries are shifting to even cleaner.

He attributed the slow investment to what he called the “docility of political leaders and a stubborn economic mentality”, adding that Nigerians must now view CNG as a new technology even though it is not.

Zone called for an aggressive, nationwide CNG infrastructure rollout, suggesting that part of the funds saved from recent subsidy removals should be used to set up mobile dispensers, mother stations, subsidies for vehicle conversion, and mass deployment of CNG facilities.

He criticised the current CNG rollout as being focused mainly on the Southwest and Abuja, leaving out key areas like the South-South and Southeast.

“There should be simultaneous deployment of assets across the country to lower transportation costs and boost food affordability,” he said.

Zone highlighted the complacency of regional leaders in the South-South and Southeast, accusing governors of a “nonchalant attitude” toward advancing CNG access for their citizens. He pointed to the potential economic benefits if CNG infrastructure is widely established, suggesting that it would become a lucrative market with widespread access.

However, he warned, Nigeria risks falling behind in other fuel technologies like LNG, hydrogen, and electric vehicles, areas where countries like Mozambique are now attracting significant global investments.

The National President of the Nigerian Association of Road Transport Owners (NARTO), Lawal Yusuf Othman, said until there are enough refilling stations, the scheme would remain a challenge, adding that the current situation is bad for business.

“There is no refilling station. Even if we convert, we have to queue for over two days just to fill our cylinders. This is not good for business,” he said.

Othman noted that the conversation is also not as fast as expected because it takes up to five hours to convert one vehicle.

“If you convert, the standard is for you to instantly get gas into the vehicle but after conversion, you may not get gas for the next two days. The process lacks efficiency,” Othman said.

The Major Energies Marketers Association (MEMAN) also claimed that the slow investment in CNG was caused by the fact that the technology is new to the market unlike LPG, which the government had encouraged the marketers to invest in.

Executive Secretary of MEMAN, Isong Clement, said members of the group are committed to driving CNG and are already sealing deals that would see deployment.

MEMAN disclosed that building a CNG station could cost as much as over N1 billion and that critical gas infrastructure is necessary for the success of CNG, especially pipeline infrastructure.

The government’s plan to convert one million vehicles to CNG within a short time frame is seen as ambitious but potentially unsustainable without critical investments in refuelling stations, storage facilities, and robust regulatory backing.

A renowned energy expert, Prof. Wunmi Iledare. said CNG can only be a short-term solution.

Iledare noted that apart from being a means to reduce the current impact of the removal of subsidy, the scheme must be a permanent option for transportation in the country.

Energy Economist, Kelvin Emmanuel told The Guardian that the CNG initiative for cars below 2,000cc will fail because the fundamentals are wrong.

He stressed that the reason marketers have refused to invest is that beyond setting up CNG pumps at their retail stations, they also have to be guaranteed gas feedstock at compression plants as well as the trucks that will transport the skids to fueling stations since Nigeria lacks high-pressure transmission pipes to transport gas to pressure metering and reduction stations across the country.

A marketer, who pleaded anonymity, cited the capital-intensive nature of the project and prevailing policy uncertainties as major obstacles preventing marketers from fully committing to the program.

He mentioned that these challenges are the reasons marketers are not moving as fast as the government would probably want them to move.

“CNG is the way to go, we knew, and that’s why we bought 20 buses for the federal government, which they have also given out. But the capital-intensive nature and the fear of policy somersaults, in which case you would have invested on it and somebody would just come tomorrow and change it, those are the fears marketers have for now,” he said.

He explained that some marketers are gradually working to upgrade their stations by adding CNG outlets or integrating them into existing retail outlets. He expressed confidence that the adoption of CNG would soon rise significantly compared to its current level.

He mentioned that a lot of marketers are trying to access the FG’s single-digit loan, the Midstream and Downstream Gas Infrastructure Fund (MDGIF) which would enhance the investments in CNG outlets.

“A number of my people are trying to access the federal government single-digit loan that is set aside for the purpose, and once they do that, with their feasibility studies and it is approved, they are good to go, Infact Nigeria Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) didn’t compel, but the marketer’s station will get faster attention if you have a CNG add-on whether you want to renovate or you want to build a new one,” he added.

He noted that safety concerns may have initially discouraged people, but both NMDPRA and marketers are actively enlightening the public on CNG safety. He emphasised that CNG is safe if users follow instructions and maintain their equipment properly, with risks arising only from neglect. Drawing a parallel, he pointed out that while gas cookers have been widely used for years, occasional accidents don’t make gas cookers, cylinders or liquefied petroleum gas (LPG) unsafe.

Another expert, Olusesan Okunade, expressed that while the cost of conversion might initially seem high for an average person, it proves to be highly economical in the long run. However, he highlighted that availability remains a significant challenge.

He urged the government to create incentives and a supportive environment for investors, emphasising that when demand exceeds supply, it becomes a critical issue.

![[FILES] A picture shows the Argentinian flag. (Photo by DANIEL LEAL-OLIVAS / AFP)](https://cdn.guardian.ng/wp-content/uploads/2020/11/Argentina-.jpg)