A little over a year ago, I called on President Muhammadu Buhari to make Nigeria the first country on Earth to abolish cash.

Perhaps, he was listening.

Last week, the President announced that Nigeria is to become the first African nation to introduce a digital currency.

The said eNaira is designed to cut transaction costs and boost participation in the formal financial system, with the President stating in a televised address that its technology can also “increase Nigeria’s gross domestic product by $29 billion over the next 10 years”.

This is the Nigeria we want to see: bold, creative, modern, capable of continental leadership – and driven by digital technology.

In many ways, we are the ideal society to pilot this innovation. Within the next couple of years, the vast majority of Nigerians will own a smartphone, and our nation is already home to Africa’s greatest and most important e-payment businesses – such as Flutterwave, Opay and Andela.

It has always been something of an amusement to me that while many Nigerians are used to receiving money electronically from relatives overseas, our entire economy still expects them to queue up at kiosks for cash when spending that money at home – when every transaction can be done electronically with the touch of a button!

Although old-fashioned, and will be with us for some time to come, there is no question cash’s days are numbered.

It’s not just out-of-date – in a time of Covid-19 and civil insecurity – it’s not even safe.

But the real benefits of a digital economic system could be the ones that benefit our democratic system.

Physical cash is dirty money in more ways than one indeed – corruption is a lot easier in any system that relies upon it.

Minimising the use of cash in public life could be an important step towards restoring Nigerian’s trust in the democratic process.

Transparency and accountability are practically impossible with anonymous and untraceable cash payments. And this has huge implications when it comes to making sure public money goes where it is supposed to go.

As an example of how this can work, look at India. When the Indian government began to make pension payments digitally instead of using cash, incidences of bribery halved. I can’t be the only Nigerian to long for that happening here.

This is another area where Nigeria is making huge progress. Covid-19 saw impressive efforts from the government to make palliative payments electronically – and saw the government take impressive and important steps to enhance the transparency and governance of Covid-related spending, including the publication of procurement plans and notices for all emergency response activities including the names of companies awarded contracts and the owners of those companies.

Now, we need our politicians to pursue transparency too.

At the digital democracy campaign I lead, we are determined to improve accountability and transparency in Nigerian politics by using technology.

We have created a free app called Rate Your Leader, which allows voters to contact directly with their local elected representatives. The Rate Your Leader app helps politicians engage directly with the people who elected them, building relationships based on mutual trust and respect.

Rate Your Leader also helps local leaders explain and justify every decision they make and every penny they spend – making them truly accountable to the people they serve.

And if their voters don’t like the answers they get, they can rate their politicians appropriately for everyone to see.

In 2021, we live our lives digitally. We shop, socialise, learn, work and even date there. So why does our economic system still expect us to make transactions the same way as our ancient ancestors?

At our campaign, our message is clear: Our politics and our political institutions need to take advantage of the opportunities of the digital age to become more accessible, transparent and responsive – and to make themselves relevant to the people they serve.

Too much of our public payment, welfare and public transport infrastructure remains entirely cash-based. This has to change. But the creation of the eNaira is a great step towards a cashless Nigeria – and an international achievement we can all be proud of.

This would require significant government commitment and investment. But the government could start tomorrow by aiming to make all government payments – such as Conditional Cash Transfer – digital by default.

Our country is becoming digital. Our currency cannot remain analogue.

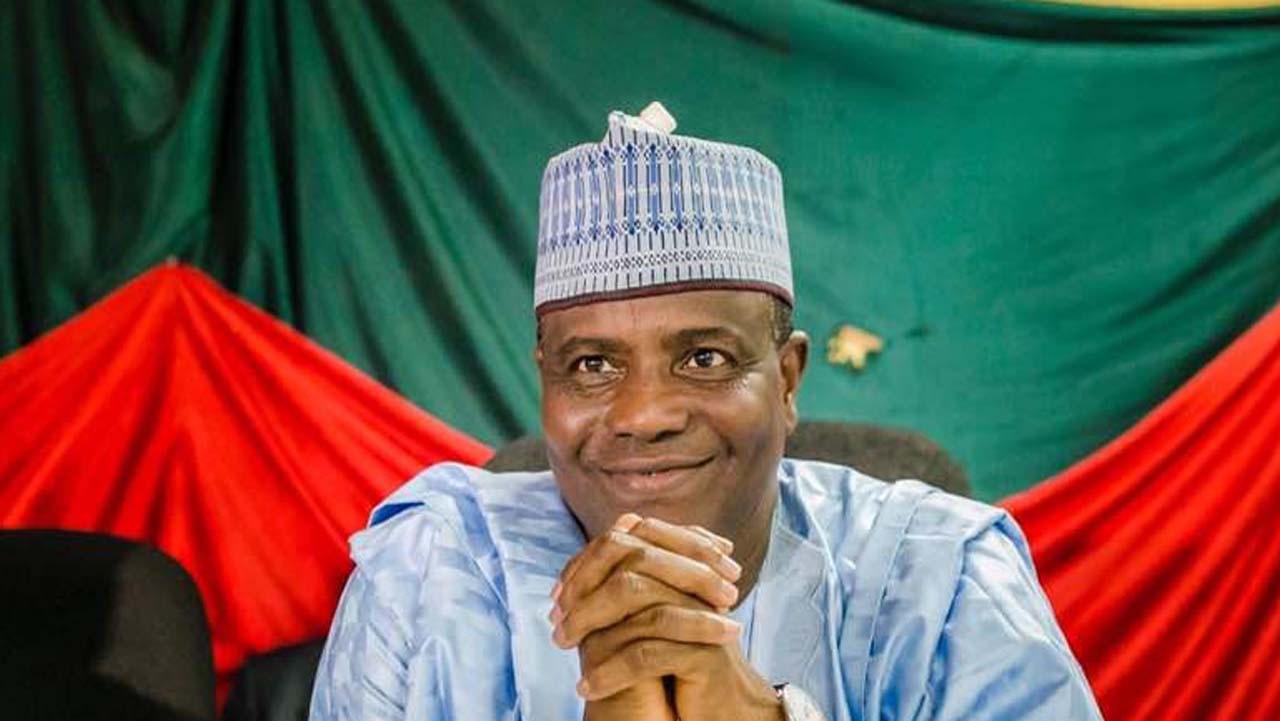

Joel Popoola is a Nigerian technology entrepreneur, digital democracy campaigner and is the creator of the Rate Your Leader app. Follow him on Twitter @JOPopoola