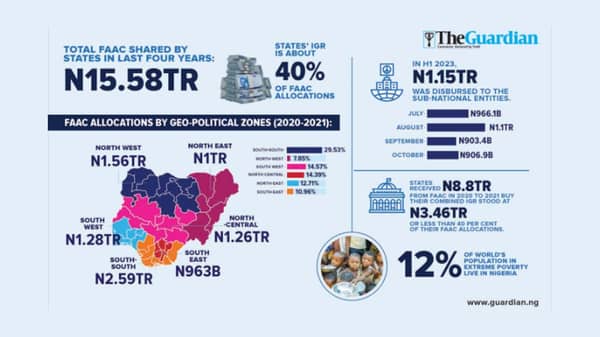

•Sub-nationals share N15.8 trillion from FAAC in four years

• Corruption, poverty, insecurity, disputes retard growth

• IGRs less than 40 per cent of states’, LGs’ allocations

• Silence over CBN salary bailout loan status

Despite raking about N15.8 trillion from the Federation Account Allocation Committee (FAAC) in less than four years, the majority of sub-national governments are reeling in huge debts just as some are showing signs of distress. But the huge indebtedness, poor infrastructure funding and financial stress have not stopped mind-boggling profligacy on the parts of the states’ administrators.

While a report by the Nigeria Extractive Industries Transparency Initiative (NEITI) showed that between 2020 and 2021, the states shared about N8.8 trillion, checks by The Guardian revealed that as of 2022, the 36 and the Federal Capital Territory (FCT) had received N3.16 trillion.

In the first half of 2023, N1.15 trillion was disbursed to the sub-national entities. In July, they received N966.1 billion; August, N1.1 trillion; September, N903.4 billion and October, N906.9 billion, bringing the total amount shared in the past four years to N15.58 trillion.

The federation distributes revenue generated every month from its different revenue sources units to the federal, state, and local governments, in line with both horizontal and vertical sharing formulae. The sources include electronic transfer levies, value-added tax (VAT) and remittances from other revenue-generating agencies.

It has been argued that the central funding arrangement has not encouraged creativity among the states as most of them rely mostly on FAAC allocations to fund their activities.

Indeed, while the state governors wait for Abuja every month to be spoon-fed, their internally generated revenue (IGR) potentials are ignored or sub-optimally utilised. For instance, while they received N8.8 trillion from the common purse in 2020 to 2021, their combined IGR stood at N3.46 trillion or less than 40 per cent of their FAAC allocations.

That about 41 per cent of the total IGRs generated by Lagos underpins the level of viability crisis facing many states. Some states, for instance, generate less than N10 billion as their total IGRs for a year. In 2021, IGRs of Kebi, Taraba and Yobe were below N10 billion each.

Rather than leveraging internal potential to support FAAC sources, states have continued to indulge in debts. As of 2020, the Debt Management Officer (DMO) put the domestic debts of the states at N4.18 trillion. The figure rose to N4.45 trillion in 2021 and N5.33 trillion in 2022. As at the end of the first half of the year, the figure was N5.815 trillion.

Meanwhile, most of the states are said to have been exposed to different debts granted by commercial banks but not documented with the DMO. It would be recalled that the former minister of finance, Zainab Ahmed, told a gathering of financial experts at a forum of the African Development Bank (AfDB)

The state governments, ex-President Muhammadu Buhari, prevailed on the Central Bank of Nigeria (CBN) to provide budget support to the state governments that were facing financial stress and grappling with difficulties in payment of salaries. The last word anybody heard about the facilities was when the former CBN boss, Godwin Emefiele, threatened on the heels of his conflict with the Edo State Governor, Godwin Obaseki over an allegation of excessive quantitative easing, that the apex bank would commence deducting the loans. Whether the deductions were done as threatened or whether the full amounts have been recovered are matters of speculation to date.

In their half-year financial statements, some banks made veined reference to the opaque salary bailout funds.

In Access Bank financial statement, it was stated: “The amount of N58,842,651,795 represents the outstanding balance on the state salary bailout facilities granted to the bank by the CBN for onward disbursements to state governments for payments of salary of workers of the states. The facility has a tenor of 20 years with a two per cent interest payable to the CBN. The bank is under obligation to on-lend to the states at an all-in interest rate of nine per cent per annum. From this creditor, the bank has a nil undrawn balance as at 30 June 2023.”

On its part, Fidelity Bank reported: “FGN Intervention fund is CBN Bailout Fund of N80.65 billion (31 Dec 2022: N82.07 billion). This represents funds for states in the Federation that are having challenges in meeting up with their domestic obligation including payment of salaries. The loan was routed through the bank for on-lending to the states. The bailout fund is for a tenor of 20 years at nine per cent per annum.”

It added, “The bailout fund is for a tenor of 20 years at seven per cent per annum and availed for the same tenor at 9 per cent per annum until March 2020, the rate was reduced to five per cent for one-year period due to COVID-19 pandemic to March 2021 after which it was extended to February 2023. CBN on August 17 2022 further reviewed the rates in response to the economic outlook and approved the following order; All intervention facilities granted effective July 20, 2022 shall be at nine per cent per annum while all existing intervention facilities granted prior to July 20, 2022 shall be at nine per cent per annum effective September 1, 2022.”

In its H1 2023 financial statement, Zenith Bank, also noted, ‘the Salary Bailout Scheme’ was approved by the Federal Government to assist state governments in the settlement of outstanding salaries owed their workers. Funds are disbursed to banks nominated by beneficiary states at two per cent for on-lending to the beneficiary states at nine per cent. The loans have a tenor of 20 years. Repayments are deducted at source, by the Accountant General of the Federation, as a first-line charge against each beneficiary state’s monthly statutory allocation. This facility is not secured.”

A breakdown of the NEITI report (2020 and 2021) showed that in terms of geo-political zone allocations, the South-South received the highest allocation with N2.59 trillion, which represents 29.53 per cent of the total revenue disbursed to states and local governments.

According to NEITI, the North-West got N1.56 trillion, representing 7.85 per cent; South West, N1.28 trillion, representing 14.57 per cent; North-Central, N1.26 trillion, representing 14.39 per cent and North-East, N1 trillion, representing 12.71 per cent for the period under review.

The South-East had the lowest allocation of N963 billion or 10.96 per cent of the total allocation. Catchphrases such as Budget of Deep Vision, Budget of Infinite Transposition, Budget of Transformation among others are common slogans that have not translated to any expressions of performance. Rather, the budgets have further impoverished many, leaving them at the mercy of a few individuals, who control government coffers.

Checks by The Guardian showed that despite the huge monthly allocations, most states are getting worse across performance indices. Standard hospitals, schools, good networks of roads, independent power generation, affordable housing, especially for low-income earners missing, food affordability, modern facilities among others remain a mirage.

According to Statista, in 2023, nearly 12 per cent of the world population in extreme poverty lived in Nigeria, considering the poverty threshold at $1.9 per day.

The NBS multidimensional poverty report index of 0.257, Sokoto, Bayelsa and Jigawa States led the list of states in Nigeria with the highest multidimensional poverty index, having an aggregate of 14.18 million impoverished people. According to the Bureau, factors such as healthcare, food insecurity, education, nutrition and access to cooking fuel contributed the most to the national poverty index.