Financial crises not only result in severe disruptions to the economic system, they also affect people’s life satisfaction. A new study by Martin Luther University Halle-Wittenberg (MLU) and the Halle Institute for Economic Research (IWH) shows that weaker members of society are more affected by increased uncertainty during crisis times, even if they may not be speculating on the stock market themselves. This could potentially also lower their propensity to consume, thereby intensifying the impact of a financial crisis. The study was recently published in The B.E. Journal of Economic Analysis & Policy.

Higher uncertainty on financial markets has a direct impact on people’s life satisfaction. While this statement might seem rather obvious, it has now been scientifically proven in an empirical analysis focusing on recent crisis developments across European countries. Assistant Professor Lena Tonzer at MLU and IWH led the study. “This phenomenon, that people are less satisfied with their life in uncertain times, is heightened during financial crises,” says Lena Tonzer. And: “The effect mainly impacts the weaker members of society.” In other words, the unemployed and less well educated suffer more from uncertain financial markets, even if they themselves do not speculate in the stock market.

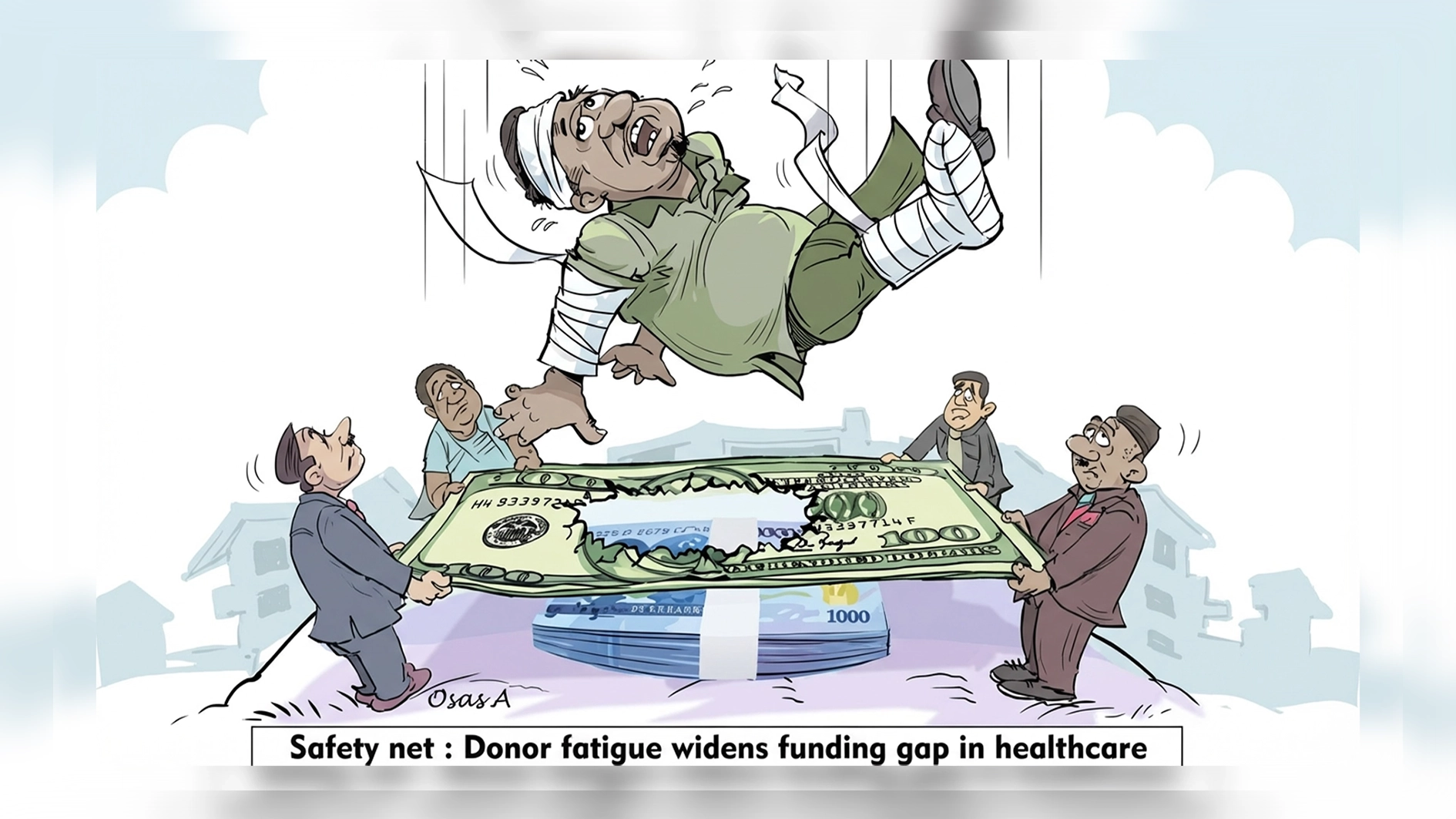

Some of Tonzer’s empirical analysis was based on data from the Eurobarometer Surveys, a public opinion survey commissioned by the European Commission at regular intervals. One key objective is to measure perceptions about EU-wide policies across the member states. The survey also includes questions about life satisfaction. This enabled Tonzer to establish that the effect of personal dissatisfaction was relatively higher in times of financial uncertainty in those countries most severely affected by the financial and sovereign debt crisis: more precisely in Spain, Portugal, Italy, Greece and Ireland. Such a rigorous analysis is not an end in itself: “It is important to identify which population groups are hit worst. This is the only way to counteract this with political measures,” explains Tonzer. There was also evidence that the effect was less pronounced in countries with an effective state-supported safety net.

This leads to several conclusions: “There are effective ways of exerting political influence to counteract negative social effects. These should be used to protect the weaker members of society.”In order to prevent financial crises from the outset or to mitigate the effects of a downturn, macro-prudential policies can be introduced, such as the anti-cyclical capital buffer. The aim of this instrument is that banks accumulate more equity capital in good times so that they have a buffer in bad times to absorb losses more easily and so that they can continue to grant loans to the real economy. The Financial Stability Committee of the Federal Ministry of Finance recently recommended that the Federal Financial Supervisory Authority (BaFin) should activate this capital buffer in Germany.

Another important point is that, while a social security system is important, it should not be expanded at the expense of an increase in government debt. The reason is that, in uncertain times, life satisfaction tends to decline more in countries with higher public debt, which in turn would further burden the system and increase people’s fears. “If they are more afraid because their future seems more uncertain, they will probably buy less and be less willing to invest compared to economically stable times. The result would be another downward spiral”, Tonzer concludes. Based on her analysis, she feels certain that “It makes sense to look at these soft factors, because everything is interconnected.”