As the world grapples with the mounting effects of climate change, banks are uniquely positioned to drive the green economy. However, for financial institutions to lead in financing sustainable projects effectively, they must prioritize training their professionals on green finance. A new training initiative by sustainability-focused experts Greenbuilt.ng an initiative by Constructability Limited will be launched in 2025 to equip banking professionals with the skills needed to make impactful, environmentally sound investment decisions.

As the world grapples with the mounting effects of climate change, banks are uniquely positioned to drive the green economy. However, for financial institutions to lead in financing sustainable projects effectively, they must prioritize training their professionals on green finance. A new training initiative by sustainability-focused experts Greenbuilt.ng an initiative by Constructability Limited will be launched in 2025 to equip banking professionals with the skills needed to make impactful, environmentally sound investment decisions.

This effort comes at a pivotal time as sustainable finance—encompassing green bonds, green loans, climate-friendly loans, and investments in green building and sustainable infrastructure—is rapidly transforming the financial sector. As banks face rising pressure to integrate environmental considerations into their portfolios, the need for specialized knowledge among employees is critical.

The program offers tailored training for various roles within financial institutions, from executives and credit officers to product developers and the sales force. Each module provides insights specific to the job function, empowering everyone from the C-suite to frontline staff to play a vital role in advancing sustainable finance goals.

The Value of Specialized Training in Sustainable Finance

For financial institutions, adopting sustainable finance practices is no longer just a regulatory concern; it is a gateway to new business opportunities and a way to mitigate climate risks. By becoming more knowledgeable in green finance, banks can navigate regulatory pressures, attract a new generation of eco-conscious clients, and even gain a competitive edge in a market increasingly driven by environmental, social, and governance (ESG) standards.

Each role within a bank plays a different part in this shift. Executives must understand how climate trends affect long-term strategy, while product developers need the expertise to create appealing green financial products. Credit and risk officers benefit from training in green risk assessment to avoid stranded assets, while the sales force requires skills to communicate the benefits of sustainable products to clients effectively.

With this targeted training, financial institutions can become proactive about climate change. “Sustainable finance is a tremendous business opportunity for banks, but only if the team is trained to manage and leverage it effectively,” said a spokesperson for the initiative. “By providing role-specific training, we’re giving financial professionals the tools to turn the green transition into a sustainable revenue stream.”

Green Finance: A Profitable Path Forward for Banks

Beyond the environmental impact, sustainable finance is a profitable opportunity. With green finance products—such as green bonds and renewable energy project loans—forecasted to reach trillions in value, financial institutions that invest in sustainable finance expertise now are well-positioned to lead in this market.

As banks invest in training, they not only open new avenues for revenue but also improve resilience against climate risks. Climate change introduces financial risks for banks heavily invested in high-carbon sectors, and understanding green finance equips institutions to identify and avoid these liabilities.

A Strategic Move for the Sector

This latest initiative aims to make sustainable finance a cornerstone of the banking sector’s future by training professionals at every level. The program is designed to help banks meet emerging regulatory demands, capitalize on new business opportunities, and position themselves as leaders in the green economy.

This comprehensive approach is a win-win for banks: they not only stand to enhance their reputation with a new generation of eco-conscious clients but also secure their position as forward-thinking institutions prepared to lead the financial sector’s green transition. As the green economy accelerates, banks that prioritize training today will be prepared to shape the financial landscape of tomorrow.

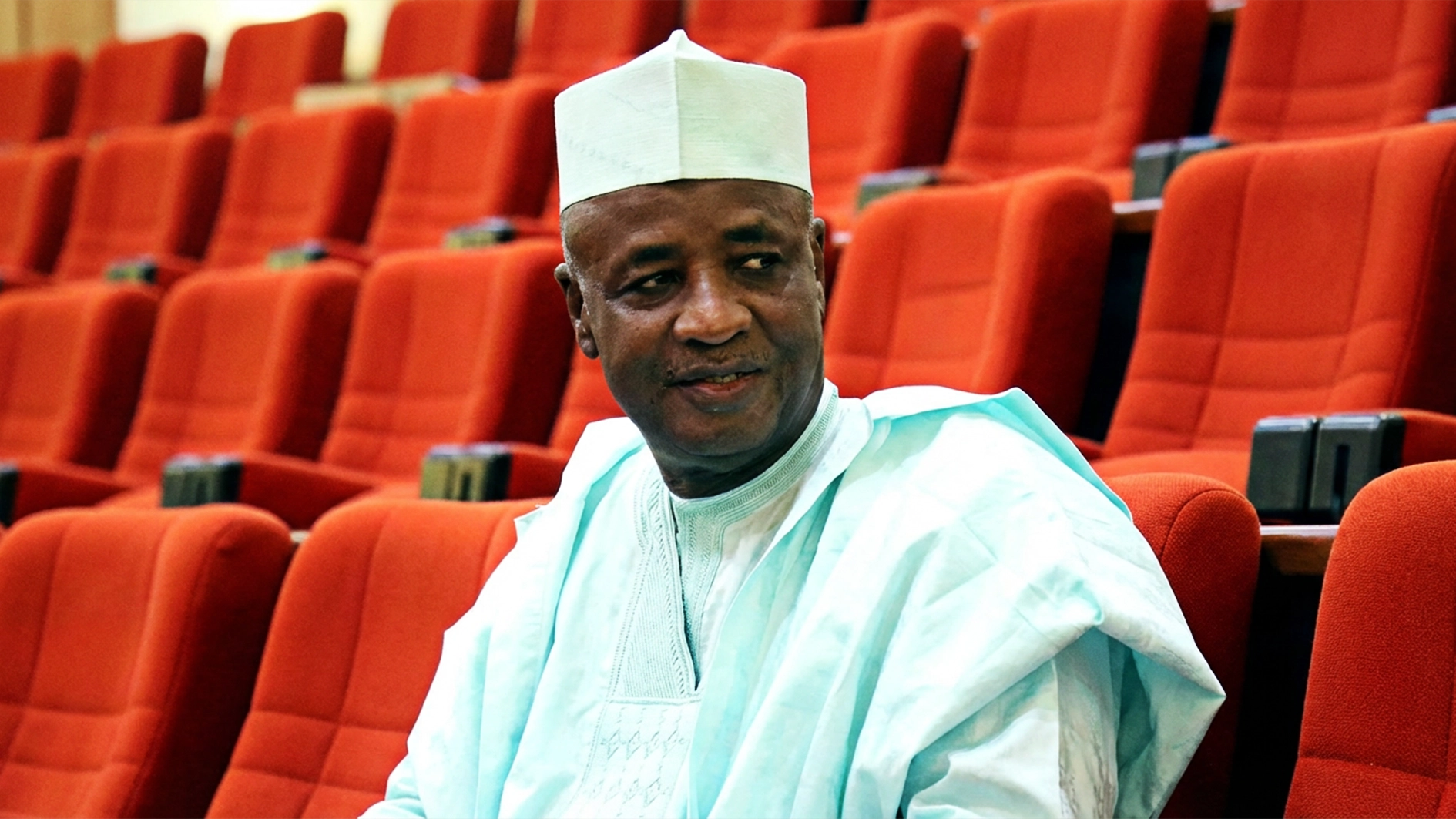

Nnaemeka Richard Dureke, a Sustainability Professional in Abuja, Nigeria.