The Managing Director/CEO, SunTrust Bank Limited, Mrs. Halima Buba, has said that fraud, corruption, insider abuse and mismanagement have caused damage to Nigeria’s financial institutions.

She, therefore, highlighted the need for internal auditors to serve as the safeguard against these risks by ensuring that governance structures are robust, financial transactions are transparent, and ethical standards are upheld.

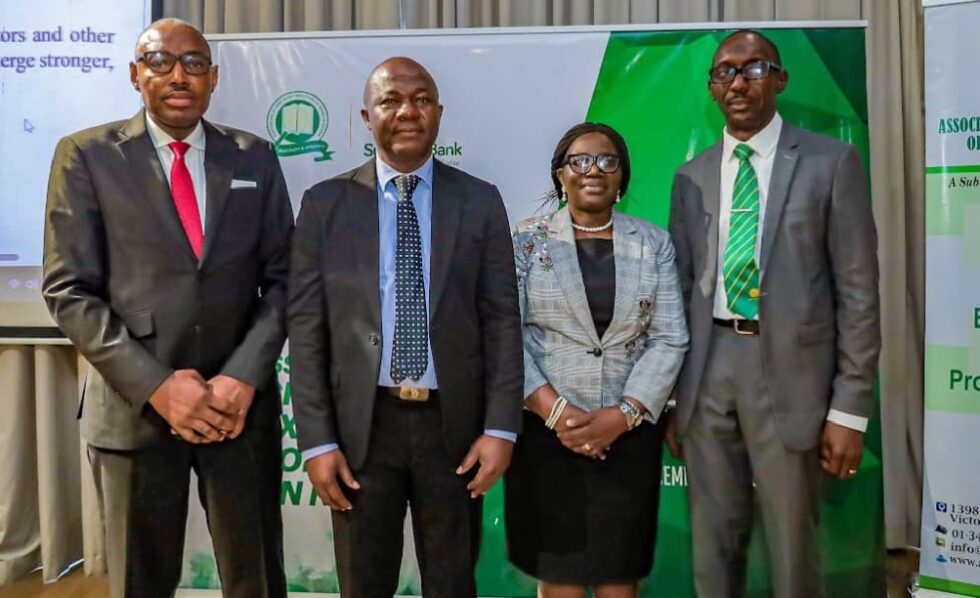

She spoke at the 60th Quarterly General Meeting (QGM) of the Association of Chief Audit Executives of Banks in Nigeria (ACAEBIN), themed ‘The impacts of financial Disruptions and the Role of Auditors’, in Lagos on Friday.

Represented by the Executive Director of the bank, Mr Innocent Mbagwu, Buba added that auditors play the critical role of financial gatekeepers, safeguarding the integrity of banking institutions through checking the numbers, anticipating risks, recommending mitigations, ensuring compliance, and advising on how banks can adapt to new challenges.

“From regulatory changes, economic shocks, and technological innovations to the impact of climate change, the forces shaping the financial landscape are complex and multifaceted.”

As internal auditors, we have seen firsthand how these disruptions challenge banks’ ability to remain stable and competitive,” she noted. Buba said that with technological disruptions come risks such as cybersecurity, adding that auditors now have the critical responsibility of ensuring that banks’ cybersecurity measures are robust enough to handle these advanced threats.

“This means assessing not only the implementation of traditional cybersecurity frameworks but also the adoption of cutting-edge detection and prevention mechanisms that address AI driven threats. Additionally, auditors ensure that these technologies align with regulatory frameworks and do not expose banks to undue risks, continuously evaluating their readiness to face emerging cybersecurity challenges and maintaining operational resilience,” she said.

According to her, duplication of regulations leave banks in a constant tug of complying with the demands, adding that open banking, though more inclusive, introduces new compliance challenges, particularly around data security, privacy, and fair competition.

Buba further said that to navigate this disruption, auditors need to ensure transparency during recapitalisation efforts and balancing compliance with local and international standards.

The Chairman, ACAEBIN, Mr. Prince Akamadu, represented by first Vice Chairman, Aina Amah, emphasised that through the association’s training programmes, internal auditors are equipped with essential skills to strengthen internal controls and ensure compliance with regulatory standards.

He stated that the association also increased collaboration with critical stakeholders, including the Department of Financial Policy and Regulation and the Consumer Protection Department of the Central Bank of Nigeria (CBN), which advanced its advocacy for robust regulatory frameworks and improved consumer protection in the banking sector.

For 2025, he stated that plans are on to overhaul existing training structure to align with emerging trends and challenges to create a standard audit programme tailored to the banking industry.

“We will organise more training sessions focused on emerging technologies, regulatory compliance, and governance to ensure our junior colleagues remain at the forefront of the profession,” he added

Also speaking, Partner, Technology Assurance, KPMG Nigeria, Lawrence Amadi, said that due to economic realities, more people would look for ways to cut corners so the need for controls on core banking should be tight, the absence of which would make banks highly susceptible.