In this report, TINA AGOSI TODO writes about how multiple taxations, and institutionalised extortion from non-state actors, including touts and security men have led to a hike in prices and food inflation in Cross River State.

Gloria Omini is a farm produce trader, whose major occupation is selling yam and garri in Calabar and its environs. She has been in this business for a while, but these days, Omini and other traders like her go out looking forlorn, knowing that most of their profits go into the pockets of government-appointed tax collectors known as ‘produce boys,’ who collect rates on every bag of food on the road.

To transport her goods from Ogoja to Odukpani, a 293km, five-hour journey, Omini must cough out money at about 50 checkpoints. Getting past each checkpoint is a Herculean task.

“We pay N1,000 per bag of garri to Calabar from Ogoja. How much profit do we expect from a bag? So, we have no choice but to increase the price of the items,’’ she stated plainly.

Omini lost seven of her trader friends to an avoidable accident along the Ugep Road to illegal barricades used as checkpoints. The incident happened in 2023.

“Whenever we travel, there is fear that something terrible may happen especially when the driver happens to be a stubborn type,” she narrated with fear.

Mercy Eteka is a trader at the Bush Market in Ogoja. She spends days in the market or sometimes sleeps in the park before she can get a driver to convey her goods. Many times, she returns to Calabar without her goods due to reluctance on the part of the drivers to transport her produce

“It could take weeks to get my goods back to Calabar. I go through a lot just to have an income to support my family; my children are in school, so I have to pay school fees, pay rent,” she expressed the economic hardship.

Inevitably, all these tell on the price of food items in Calabar. Investigation into the price of food items in markets in the state shows that it costs more to buy foodstuff in Calabar the state capital than other markets.

For example, a tuber of yam at the Bush Market in Bekwara LGA is sold for N1,200 but goes for about N4,000 when getting to Calabar Market.

“We pay between N4,000 and N5,000 to these boys, if you refuse to pay, they seize your yams. From Ogoja to Mbok, there are more than eight checkpoints. After paying for produce here, they will ask you to pay for haulage. We don’t even know the difference; they always have a name for them. For instance, when you get to Ekpogiri-Nyang in Ogoja, you will still pay, the suffering is too much and it’s frustrating,” Eteka said.

Meanwhile, Cross Rivers has recorded a surge in its Internal General Revenue (IGR) over the past year, according to recent data released by the Cross River State Internal Revenue Service (CRIRS). Its IGR surged from N6.3 billion in the first quarter of 2023 to N9.5 billion by the end of the first quarter of 2024, making an impressive increase of 49 per cent during the same period.

The Chairman of the CRIRS, Prince Edwin Okon, in one of his recent interviews, attributed the success to the expansion of the net into previously untapped areas and reducing leakages in the system.

This is not far from the findings from our investigation that checkpoints on the Cross River highways have tripled in the past year since the present administration took over power.

Findings also revealed that some of these checkpoints were mounted by some state actors in the House of Assembly, Council Chairmen, village heads and the rest. They register as revenue consultants under the IRS.

The issue of multiple taxation is one factor that has given rise to food insecurity in Cross River State.

Investigations revealed that across the 18 LGAs in the state, each has at least two points of collection or more supposedly operated by the local councils. About 50 revenue subheads are used to collect money from transporters and traders on the roads within the state.

Most times, these levy collectors abuse and intimidate drivers and traders for refusing to pay the exorbitant amount levied on them. Their vehicles are sometimes impounded for noncompliance while traders end up spending more hours or days on the road and perishable goods often result in spoilage, leading to huge losses on the part of the traders.

It appears that there is no other sector where multiple taxation is more entrenched than road taxes and haulage levies. It was discovered that lorry drivers spend about N300,000 on haulage levies from Benue State boundary communities to Calabar, while bus drivers spend close to N30,000 on sorting and levies.

Gregory Okon, a 56-year-old truck driver plies all routes across the country conveying goods to customers at major markets. He sets out every day from his loading point, hits the road from Gakim in Bekwarra Local Government Area in Northern Cross River to Calabar, where traders are waiting for their goods.

One fateful day, he set out as usual. Little did he know that ‘produce boys’ at one of the checkpoints in Gakim were going to disrupt his plan of getting to Calabar before night falls.

He narrated his ordeal to The Guardian: “This afternoon, produce boys burst my tyres when I refused to give them money. They threatened to seize my goods. If not for the intervention of some security men, they would have removed yams through the back. That is what they do all the time but today I insisted that they must give me receipt before collecting money and when I refused, they burst two tyres. I have experienced this several times.

“I transport goods from Benue State to the East and South, Abia, Rivers and other states but the situation of illegal levies is alarming in Cross River, from pole to pole these boys are there extorting money from us.”

Alhaji Danlami Saleh an oil merchant in Calabar, told The Guardian in Bogobiri in Calabar Municipal LGA, where trailers load palm oil to the northern part of the country, that illegal levies on the road are the cause of price increases in food items in the state, more than what they have in other states in south-east and south-south.

According to him, a bag of beans in Cross River is sold for N245,000 but when you go to Akwa Ibom to buy the same beans, it costs between N185,000 to N190,000 with a difference of N50,000 to N60,000. Saleh said that traders avoid Ogoja, Ikom or Ugeb while preferring to follow Aba, Ebonyi or Port-Harcourt to get to Akwa-Ibom and then enter through Calabar /Itu Road.

“If you take palm oil or cocoa out of Calabar, it seems you are dealing with cocaine because of the way those illegal boys rob and extort money from you.” he sarcastically stated.

According to the October 2022 Cadre Harmonisé, a government-led and UN-supported food and nutrition analysis carried out twice a year, nearly 25 million Nigerians were at risk of facing hunger between June and August 2023 if urgent actions were not taken.

However, the analysis is a true reflection of Nigerians’ current high levels of food insecurity, with banditry threatening the food value chain in addition to multiple taxations in the South-South region of the Country. A recent nationwide #Endbadgovernance protest belied many grievances arising from food and hunger.

Besides the usual cost for transportation of food items from within and outside Cross River State in the South-South of Nigeria, the issue of multiple haulage levies has made the cost of food items beyond the reach of the common man. This also affects the cost of the products to consumers. For instance, a transporter conveying garri from Obubra pays a minimum of N1,000 for each bag at every checkpoint. Sadly, all these costs are usually transferred to the traders –mostly women.

According to Saleh who doubles as the Chairman of Arewa Palm Oil Association, and Director, Sunnah Palm Oil Garkuwan, Calabar branch, traders with food stuff, such as yams, beans, rice, garri, potatoes and the like from Gakim town in Bekwarra LGA in Northern Cross River State, Abi and Obubra LGAs in the central, Iwuru in Biase, Ikang in Akamkpa LGAs down to Calabar in the South, faces a lot of hurdles ranging from alleged extortion from the Police, the Military, Vehicle Inspection Officers (VIO), Federal Road Safety Corp Officers and especially Produce Officers.

Mrs Martina Isu, another palm oil trader in Calabar, travels to Biase LGA in Iwuru market to buy oil in gallons, lamented bitterly when The Guardian accosted her at the Iwuru park where our goods are awaiting to be loaded in the truck, “We pay up to N5,000 to N10,000 to produce collectors and police will book you for N20,000, you have to bargain to N10,000 or less before they allow you to pass and if you fail to pay, they seize your goods worth more than the amount they requested for. Sometimes, we spend days on the road arguing and pleading.”

Lorry and truck drivers spend between N100,000 to N300,000 from the boundary between Benue and Cross River states, while bus drivers spend close to N30,000 for sorting and levies.

A bus driver plying Ikang in Akpabuyo, close to the Cameroon border, and Aba/Onitsha, Gabriel Ayimo, has to pay at several checkpoints, ranging from N20,000, N15,000, and N10,000, the lowest being N5,000.

“For produce, it’s the women traders that pay the money and it also differs, in some places, they pay between N2,000 to N15,000. It depends on the person you meet.

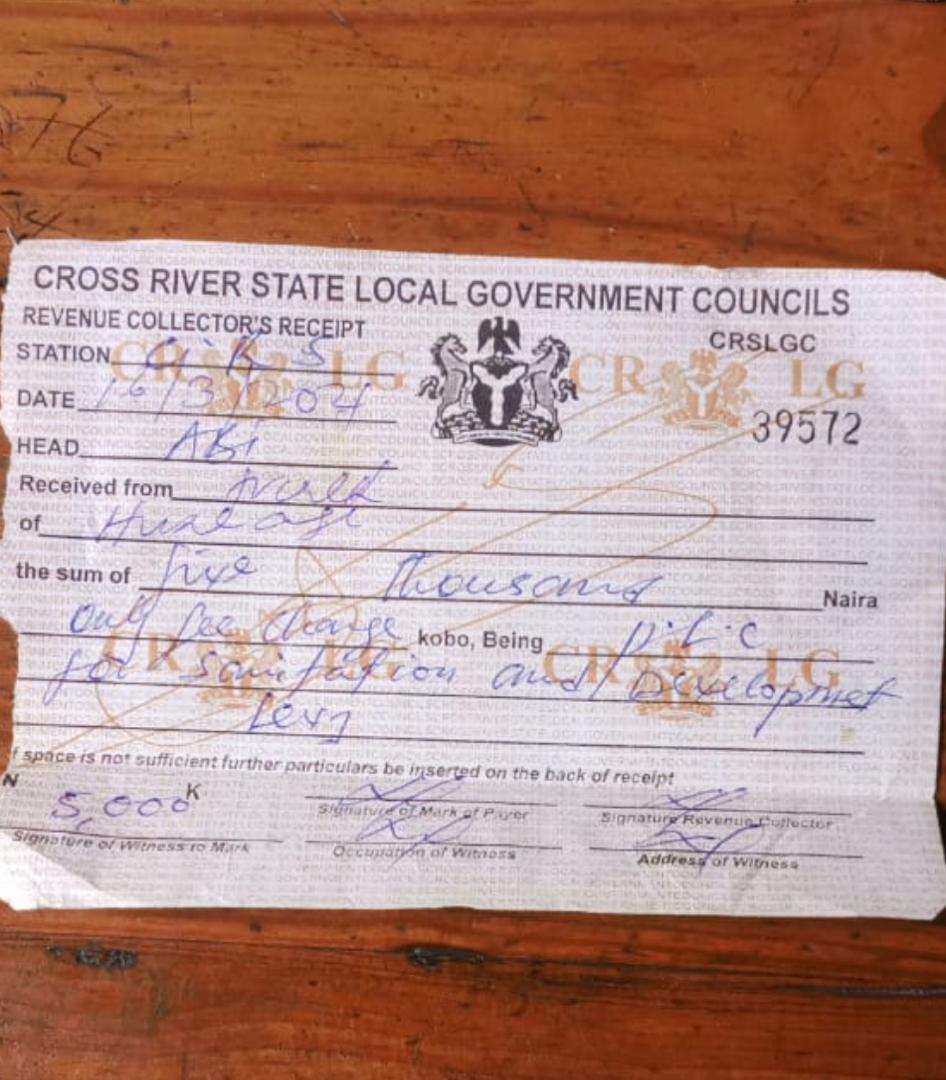

“Just from the boundary between Benue state and Cross River, I spend N152,000 and receipts are only given to us in some government checkpoints and some issue blank receipts,” Okon said the truck driver.

Saleh further revealed that immediately leaving Calabar to Iwuru in Biase LGA, illegal checkpoints are mounted at Itigidi in Abi LGA where he pays between N200,000 to N300,000 on illegal taxes.

“Then from Ugep to Gakim border between Cross River and Benue state, you also spend N400,000 on illegal taxes. They present themselves with different titles like the village head, the chairman’s boys, the senator, the house of assembly members, the youth leaders and so on.

“Sometimes they kill our drivers, break our windscreen, scatter and steal our palm oil and even cause some accidents resulting in loss of lives.”

According to the Chairman of Nigeria Lorry Drivers Association in Cross River State, Egbaji Nicholas, multiple taxations in the state have adversely affected the prices of food items within and in some neighbouring states as well.

“You see why the price of food is going up is because of these multiple taxes, you cannot spend about N200, 000 from Gakim to Calabar and not expect dealers to add extra fee to whatever product he or she is selling. Take for instance, from Gakim to Ogoja a driver or trader spends not less than N100,000 for produce alone, they say Internal Revenue Service, the road is bad, but you see people collecting money for road infrastructure, air pollution, and carbon emission.

“From one compound to another, you see checkpoints, if you are a commissioner for sports, you bring your papers to the road, you send your boys to collect money, do they play football on the road, and the highest is in Cross River State. We don’t produce most of this food, and the lowest checkpoint fee is N8,000.

“Most of the receipts issued don’t have figures on them, what do you call that? Illegality, corruption, extortion! I urged the State Governor to question the Chairman of the Internal Revenue Service about the development,” he lamented.

A consultant, Mr. Effang Effang told the Guardian that the haulage and produce business became a boom during the administration of the former governor, Senator Ben Ayade.

A consultant, Mr. Effang Effang told the Guardian that the haulage and produce business became a boom during the administration of the former governor, Senator Ben Ayade.

“Anybody you see there are not just there, they have gotten the job from the government, that is why they are there and whatever thing they are collecting from road transporters, the government has an account they remit money into. It’s like you are doing business, you pay a specific amount agreed by the government into the account, so it’s still boosting the state IGR, so that is one fact you need to know, so it shouldn’t be seen as an illegal activity,” Effang justified.

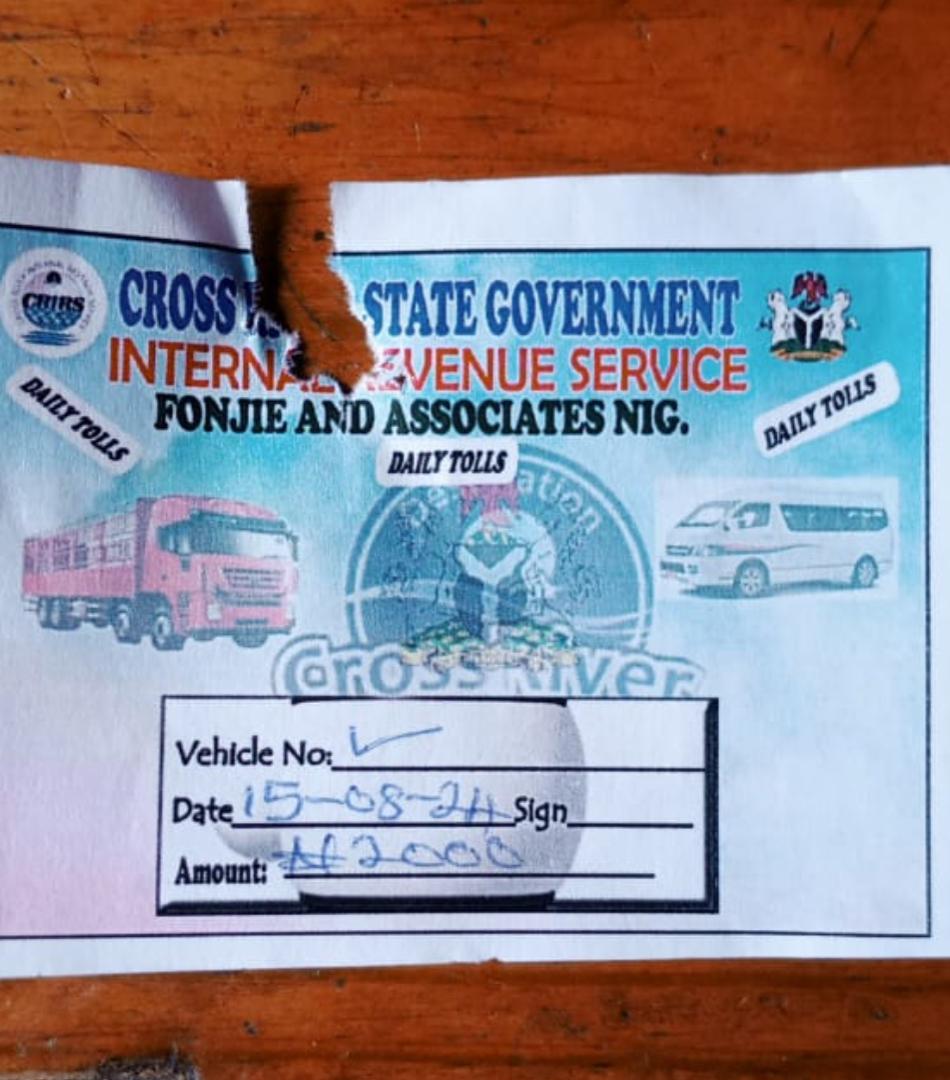

All this is happening despite efforts by the Joint Tax Board (JTB) to harmonise road and haulage taxes and levies across the country. In 2023, the federal government, through the JTB, introduced a policy aimed at addressing the issue of illegal and multiple taxations on interstate roads across Nigeria, the Single Inter-state Road Tax Sticker (SIRTS) and the Single Haulage Fee (SHF).

This was aimed at harmonising road and haulage taxes and eliminating multiple taxations as well as extortion and corruption in the system, but it was not recorded anywhere that the state kick-started the implementation of the policy in the past year when this was introduced.

However, some stakeholders have different views on whether it was implemented or not. They pointed out that the initiative has failed to achieve its purpose.

The Secretary, Road Transport Employers Association of Nigeria Cross River State Chapter, Agbor Osim had this to say: “The state government came up with a policy through the joint task board, the policy was a two-in-one policy, one was for harmonisation of road taxes and the other for harmonisation of Haulages, the joint task board came out with Single Interstate road tax stickers, and if you acquire that sticker you will not have to purchase any other sticker because everything was embedded in that single sticker and the implementation took off but that project has been abused as the purpose of that has been defeated.

“The taxes that were harmonised are all back, boys in the field are back to start selling different stickers alongside the harmonised stickers introduced by the government, all this falls back to the final consumer who has to buy the product for exorbitant price.”

He added, “It will be of note that many government agencies responsible for revenue generation have in the long run paid deaf ears to the trend even when they claim to be at the top of their games, efforts have been made to speak with representatives of the Cross River State IRS but to no avail, an attitude which sends a wrong signal.”

It was learnt that the state government had recently dismantled some illegal revenue points in parts of the state. The development followed a monitoring and inspection exercise led by the Special Adviser to the Governor on Tolls Collection, Bassey Edet, in the northern part of the state.

According to him, the state government is poised to clamp down on the menace of illegal checkpoints and tolls.

“The fight to end all illegal tolls and checkpoints is in line with the mandate of Governor Bassey Otu’s People’s First. the team has been given the mandate to enforce, inspect, and monitor all approved checkpoints and toll collection to ensure compliance and due process,’’ he added

A tax expert and associate Professor of Account in the Department of Accounting, University of Calabar (UNICAL), Dr. Obal Usang said it would take a strong political will to completely weed out political thugs parading themselves as tax contractors on the Cross River highways.

“It will require political will to weed them out of the road. Conscious, it will require some security agents to weed them out completely. And again, I don’t see how this will work, the security people that are to maintain law and order are involved in this menace, unless someone is punished,” he said.

Usang who was also a Pioneer Coordinator, Society of Women in Taxation (SWIT), the female Arm of the Chartered Institute of Taxation, added, “This system is nowhere in the tax law. I won’t even call them tax, most of the levies they collect on the highway, 99 per cent are illegal, they are not anywhere in our list of taxes.”

Director of Produce, Cross River State Ministry of Agriculture, Mr. Agbor Agbor, attributed the problem to when the government decided to contract the revenue items (Produce, Evacuation, Haulage) to political consultants.

“The problem is that the government decided to contract all those revenue items to consultants. Those people that are collecting these levies are not civil servants, and let me use the word, they are not disciplined and they are spoiling government work.

“Government has even contracted the tools we are using to monitor them, which are evacuation. That is not a revenue-generating item, but they decided to use it for that purpose. Now they are not accounting for it.

“They have chased our boys out of the road and taken over their jobs. We have written a series of letters to make sure that things return to status quo but to no avail. The politicians have jeopardised the job.

“The way forward is that government should revoke the contract from consultants and return the job back to the technical staff who were trained to handle the job and who have been disciplined through their experience as Produce men,” Agbor lamented bitterly.

The Executive Secretary, Calabar Chamber of Commerce, Industry, Mines and Agriculture, Mr Kenneth Asim-Ita argued that there was no deliberate attempt by the state government to implement the policy after the stakeholders meeting that was held in June 2023.

“I wouldn’t say Cross River State is the least signatory to the JTB accord and system. I remember that when that system was being introduced, stakeholders in the private sector, including the Chairman of the Chamber of Commerce, were invited to make input into it. Which we did and it was meant to be operated. However, after the engagement, one cannot point specifically to any deliberate attempt by government to implement that. As I said, the people that are to be held responsible entirely for that are the local government system. It’s not been operating in Cross River State. We don’t have local government chairmen.

On what the government can do for the policy to work in the state Asim – Ita submitted that “the state government needs to ensure that the implementation of the JTB regulation works and also take adequate steps to ensure the removal of the illegal checkpoints which will ease some of the payments that transporters are paying on the road.”

“It will be very difficult for the government to stop them because it’s not an organised entity, it doesn’t even have a leadership, I don’t think the government can stop them in any way that is why the so-called harmonising scheme didn’t work. Let me also tell you, this is happening across the world, it’s not just in Cross River, a tax expert, Dr. Bassey Ibor maintained.

All efforts to speak with the Chairman, Cross River State IRS, Mr Edwin Okon, proved abortive. A Freedom of Information Request (FOR) was issued to the office of the Chairman on the 20th of August 2024, yet no response whatsoever. Before the request letter was submitted to his office, our reporter called him for an interview but he directed that she reach out to his Communication Officer which she did but there was no response. After several calls and visits to the ministry, the IRS Information Officer, Mrs Achiane Adams, said there was nothing she could do as Okon had not given her the go-ahead to speak with the reporter.