• Non-competitive bidding responsible, says expert

• ‘Contracts awarded before preliminary designs’

• NRC is in better position to speak on subject, insists transport ministry

• We’re not part of contract signing, NRC says

• Kano-Maradi project signed despite AfDB funding advisory

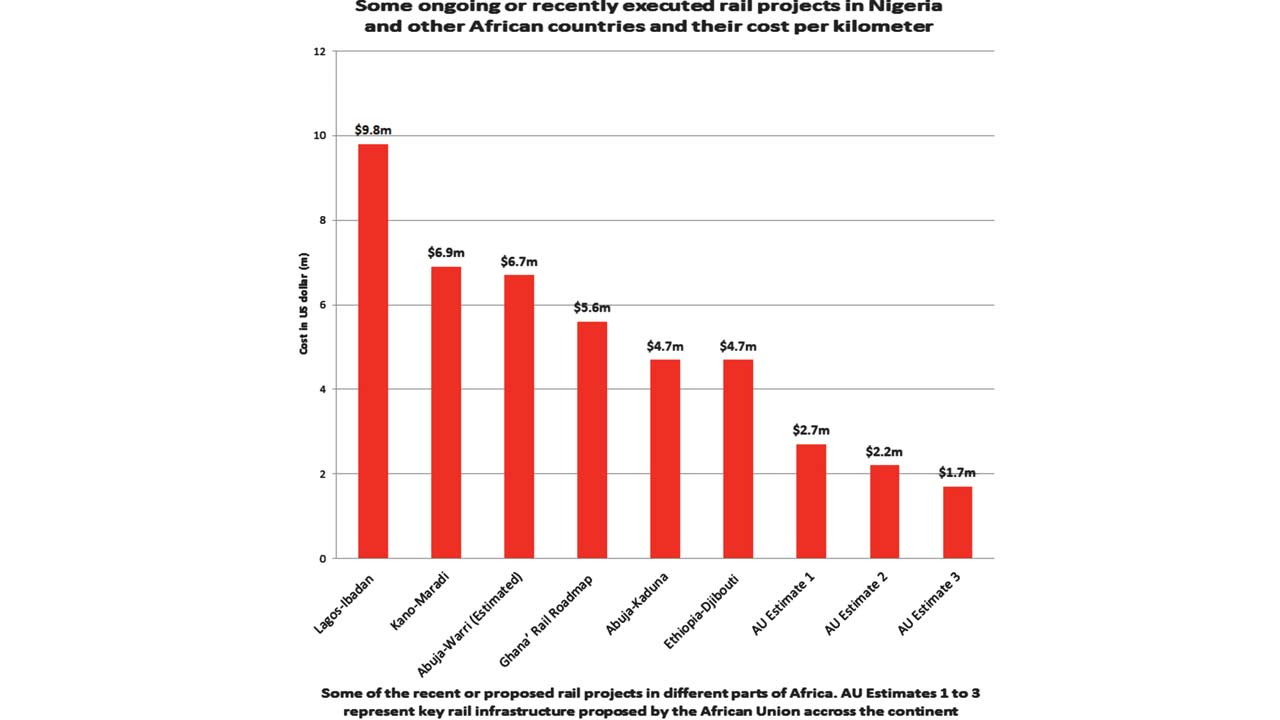

An investigation has shown that the average cost per kilometer (km) of the newly contracted Kano-Maradi rail line exceeds similar projects under the Programme for Infrastructure Development in Africa (PIDA), as estimated by the African Union (AU) by, at least, 100 per cent.

The Federal Government, recently, announced that it signed a Memorandum of Understanding (MoU) with Mota-Engil Group for the construction of the 283.75 Kano-Maradi standard-gauge rail at a contract cost of $1.959 billion.

A press release by the Federal Ministry of Transportation said the line would traverse Jigawa and Katsina to get to Maradi in the Niger Republic, raising eyebrows from different parts of the country.

A breakdown of the contract sum shows that it will cost the Federal Government approximately $6.91 million (or N2.6 billion) per km to deliver the project expected to be ready in the next three years.

Findings have shown that it is much cheaper to deliver similar projects in other parts of Africa. More importantly, the quotation for a similar distance under Africa’s rail connectivity programme being discussed at the continental level is less than half of what Nigeria will spend to execute a bilateral project but which the country has chosen to shoulder alone.

In an AU document titled ‘Towards the African Integrated High-Speed Railway Network (AIHSRN) Development’ exclusively obtained by The Guardian, the Union puts the estimates of the new railway line needs of the continent at 12, 000km, which are expected to be completed at a cost outlay of $36 billion.

“Under PIDA, 11 ARTIN corridors have been determined to require modernisation of existing railway lines and construction of new, modern rail lines as soon as possible as traffic demand is expected to exceed 10 million tons annually by 2040. In this regard, it is estimated that about 12,000 km of new railway lines would be built under the PIDA programme at a cost of about US$ 36 billion,” the strategy document revealed.

At the estimated cost, the quote per km of rail track is $3 million, which is 57 per cent less than what the Nigerian Government, which has been part of the AU rail programme conceptualisation, will pay the Portuguese-owned Mota-Engil Group for the Nigeria-Niger rail contract.

The PIDA framework is part of the development of the African Regional Transport Infrastructure Network (ARTIN), which consists of the nine Trans-African Highways and 40 key corridors. There have been multilateral treaties and endorsements leading to the drafting of the implementation roadmap.

The First Conference of African Ministers responsible for the Railway Transport System was held in 2006 in Brazzaville, Republic of Congo, leading to the adoption of the Brazzaville Declaration and Plan of Action on African Railways.

This was followed up with the Railway Professional Conference on Interconnection, Interoperability and Complementarity of African Railway Networks held in Johannesburg in 2007 where the strategies for harmonizing standards for infrastructure, equipment and operational procedures for African railways were considered and adopted.

The regional infrastructure integration itself is a fallout of elaborate discussions on regional integration to facilitate trade and labour mobility, part of which was harmonised in a series of documents such as the Abuja Treaty, a roadmap on growing, self-sustained, competitive and regionally-integrated continent.

PIDA specifies critical rail infrastructure, which is consistent with the overall cost estimation. There is the Dakar-N’djamena-Djibouti Corridor Trans-African Highway whose rail component is estimated to cover 5,139 km and estimated at $14.050 billion or at $2.7 million per kilometer, much lower than any new rail project being executed in Nigeria.

The Djibouti–Libreville Corridor rail, stretching across a distance of 2,366 km will cost $2.2 million, which is just 31 per cent of what a cash flow-challenged Nigeria will incur on each stretch of km of the Kano-Maradi line.

The 2,891 km Cotonou-Niamey-Ouagadougou-Abidjan Railway is a hybrid project with 1,234km marked for construction and the remaining 1,657km for rehabilitation). The combined project cost estimate is $5.002 billion, making the cost per km $1.7 million.

In a telephone conversation at the weekend, with Director of Press at the Transportation Ministry, Eric Ojikwe directed our correspondent to engage the Nigeria Railway Corporation (NRC) on the technical issues that could have made Nigeria’s rail projects costlier than those of other African countries.

But the Corporation’s spokesperson, Mr. Mahmood Yakubu, insisted NRC knows little or nothing about details of the contracts. “They cannot refer you to me knowing well that my office does not take part in the signing; nobody is privy to what they are doing at the ministry,” he noted.

But a transport consultant and railways specialist, Roland Ataugba, told The Guardian that there is no technical justification on why Nigeria’s rail projects could have been delivered at a higher cost than any similar projects in any parts of the world besides uncompetitive bidding and political factors.

Rolland, who is vast in Nigeria’s rail project history, said: “The contracts were not competitively procured. They were mostly outcomes of political agreements between the presidents of Nigeria and China. The absence of competition in tendering does not incentivise keenness in pricing.”

Ataugba also noted that the projects are contracted before preliminary designs are carried out, implying that the contractor “prices on a big guess and would factor in all kinds of risks.

“Indeed, we are now notorious for appointing the contractor before consultants. So, we lose out on the benefit of competent advice before committing to a contract.

“We also almost always choose the engineering, procurement and construction (EPC) form of contract and lately EPC and financing (EPC+F) which have tended to be more expensive than traditional forms of engineering contracts,” he argued.

IT is not only the cost of the recent project that is seemingly overvalued. While there is no official data on the distance between Abuja and Warri, which is to be linked with a rail in a 30-year project, the existing Itakpe-Warri (that is being extended to Abuja) is 320 kilometer. If Itapke to Abuja is 262 Km by Google Map estimation, the new entire line, when completed, could be roughly estimated at 582km

China Railway Construction Corporation International (CRCCI), which is involved in rail projects across the world, has signed an MoU with the Federal Government to deliver the project at $3.9 billion. There is nothing in the statement by the Ministry of Transportation to show whether the entire stretch would be re-constructed or if it is the newly-completely Itakpe-Warri that would only be upgraded. Whichever the detail of the contract is, it will cost $6.7 million per km of the project that will be 85 per cent financed by CRCCI and its sister company, Exim Bank of China.

“In the agreement, it is 15 per cent Nigeria and 10 per cent CRCCI. Then, we will borrow the remaining 75 per cent from the Chinese Exim Bank through a special purpose vehicle (SPV). Part of the agreement is that CRCCI will provide us with a performance bond before we give a sovereign guarantee for them to be able to borrow the remaining 75 per cent,” the Minister of Transport, Rotimi Amaechi, said.

IN terms of per km cost, Lagos-Ibadan is the most expensive project delivered under the ongoing rail reform programme. According to official statements, the project, which covers a 156km stretch connecting the two biggest cities in the Southwest, cost $1.53 billion to execute, making it costlier than the Kano-Maradi in terms of cost per km. The rail project was completed at $9.8 million per km.

In AU AIHSRN, the estimated cost of rehabilitating existing 17, 200km rail tracks that crisscross the continent is pegged at $7 billion or $406,987 per km. The regional pricing benchmark is only 4.2 per cent of what Nigeria sunk in the debt-funded Lagos-Ibadan rail, which many experts agreed was equally rehabilitated.

Other ongoing or completed projects funded by national governments across Africa are equally more expensive than the AU estimates but the majority of them are far less than Nigeria’s generously executed programme.

For one, Ethiopia’s flagship rail project in the wake of the renewed interest in the infrastructure in the continent, Ethiopia-Djibouti Railway Line Modernisation cost $3.52 billion. The project, which was completed in 2016, is not half the cost of Lagos-Ibadan in terms of per mile estimation.

But cost efficiency is not the only lesson Nigeria could learn from Ethiopia. Unlike Nigeria’s ‘big brother’ posture in the Kano-Maradi project, the Ethiopia-Djibouti project was financed by the two benefiting countries. The Ethiopian government took responsibility for $3.4 billion of the total investment while the Djibouti Government contributed $878 million.

But cost efficiency is not the only lesson Nigeria could learn from Ethiopia. Unlike Nigeria’s ‘big brother’ posture in the Kano-Maradi project, the Ethiopia-Djibouti project was financed by the two benefiting countries. The Ethiopian government took responsibility for $3.4 billion of the total investment while the Djibouti Government contributed $878 million.

The funding model of Ethiopia and Djibouti reflects the recommendations in the Trans-African rail programme, which envisages that each country takes its infrastructure to its border while its neighbour continues from there, making the connectivity less burdensome for member countries of the regional bloc.

Modernisation of Ethiopia-Djibouti Railway Line Modernisation involved replacing the meter-gauge section with a 1,435mm gauge line, and electrification at 25kV designed to accommodate trains travelling at 120km/hour. The new line was constructed in compliance with Chinese electrified railway standards, say Ethiopian local media.

All included in the cost outlay were 21 stations and equipped with ticketing and refreshment facilities. A total of 61 bridges, 37 frame bridges and 453 culverts were part of the project that was majorly handled by CRCCI and China Civil Engineering Construction Corporation (CCECC). The Chinese are to manage operations on the line for five years while providing specialist training for local employees.

The timely delivery of the project covering a distance of 756km also caught attention. It was initiated in 2011 while trial service on the Ethiopian section commenced in October 2016, followed by that of Djibouti in January 2017.

PERHAPS, Ghana’s rail roadmap is a lesson for Nigeria’s programme, which many people have described as vague. The Ghanaian government has a comprehensive rail roadmap programmed in six phases. The blueprint contains specific projects, distance and cost estimates for yet-to-commence infrastructure.

Apart from phase one, which consists of western and eastern lines put at $4.2 million per km, the average cost (per km) of the Ghana rail project is $5.6 million, which is $1.3 million less than the cost of Nigeria’s Kano-Maradi line due to commence soon.

In its Rail Infrastructure in Africa Financing Policy Options, a document assessed by The Guardian on Wednesday, African Development Bank (AfDB) has cautioned that railway financing should prioritise projects that focus on identified markets that generate high volumes.

The recently signed Nigeria’s project may have disregarded this caution. With a landmass of 72 square meters, Maradi’s population, as estimated by the World Bank in 2012, is 267,249, a little above the population of Shagamu, Ogun State, as of 2006 when Nigeria conducted the last census.

This leaves many experts, including Dr. Chiwuike Uba, a consultant to the World Bank, wondering the commercial value of extending the line to the small town and how the project advances the economic agenda of the country.

Nigeria’s railway programme may have not also been aligned with AfDB’s sustainability policy options as encapsulated in the document referenced. The regional development finance institution recommends that African countries introduce a systematic approach to railway project identification and preparation; include railway financing as part of a broad sustainable transport policy; establish clear and stable commercial agreements for passenger services, set up railways infrastructure and maintenance funds and consider larger financial packages and long term involvement.

It also urges them to develop monetisation methodologies for social, economic and environmental benefits derived from railways, adapt finance solutions to different railway business models; explore alternative PPP approaches including separation of infrastructure and operations; promote capacity building and training centres to increase railways know-how at all levels of decision and operations, while improving regulation and monitoring bodies. They are also required to coordinate the acquisition of rolling stock and maintenance and alignment of operating procedures among African countries as well as set up a task force for African railways.

Commenting on Nigeria’s rail project burden, Uba said: “The cost of rail construction is highest in Nigeria compared to other African countries. For example, it costs about $6.5 million, $5.6 million, and $9.6 million per kilometer to build a standard gauge rail track in Ghana, Kenya and Nigeria, respectively. Note also that Maradi is not Niger’s main city. The government of Niger already has a bilateral treaty with the Republic of Benin for the construction of a railroad from Cotonou to Niamey (the main city in Niger).”

Commenting on the MoU of the Kano-Maradi rail project, Minister of Transportation, Amaechi said: “The contractor, Mota-Engil Group, a Multinational Engineering and Construction firm has also agreed to build a University as part of their CSR while working on the project.”

Uba, like other public analysts, said it was curious that a contractor would build a university as CSR.